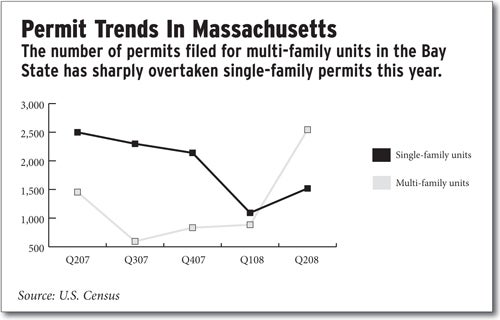

Permits For Multi-Family Buildings Jump | Rental market lone bright spot in local real estate economy

With gloomy sounds coming from seemingly every part of the real estate world, it’s quite a shock to see any number other than foreclosures going up.

Yet in the second quarter of 2008, building permits issued for multi-family homes in Massachusetts rose 75 percent, according to census numbers.

Some in the industry say the jump reflects an area that they’re increasingly taking advantage of: cheap apartment buildings that can be gutted and brought back to life.

Low, Low Prices

Russell Haims, a Wayland investor who buys and improves apartment buildings in Worcester through his company, Hampton Properties LLC, said he’s been taking on more projects in recent months.

“I would say my involvement is doubling or more because I was a little more cautious during the boom,” he said.

Haims said he is well-positioned to take advantage of drops in prices because he doesn’t depend on increasingly tight bank credit. But he said even people with less money to spend are now beginning to be able to afford rental properties as banks foreclose on more of them and then try to get them off their hands as fast as possible.

That’s especially true in places like Worcester where foreclosure rates are high.

“I believe that it’s a stable and decent business as long as you budget properly for a lot of the hidden surprises,” he said.

Haims said when a building’s utilities are turned off, new buyers must take out permits, and rebuild properly so that everything is up to code, before they can be turned back on.

That’s good for the ultimate quality of local rental housing, but it’s expensive for investors.

Ilan Carmi, a MetroWest investor and commercial and residential landlord, said it’s not just foreclosed buildings that are turning over rapidly and generating lots of permit-necessitating activity.

He said many owners who are trying to refinance their buildings these days discover that the property’s value has declined, while a tighter credit market means banks will loan them a lower percentage of that value than in past years.

That can mean refinancing won’t put any money in their pockets

“Some property owners found themselves in a situation where they had to write a check to refinance the property,” Carmi said. “That is putting a lot of pressure on the market to sell the property rather than refinance it.”

Besides increasing activity by people who may have been cautious about getting involved in the housing bubble, according to Worcester Housing Director Scott Hayman, another source of new development in multifamily buildings may be builders who are moving away from single-family subdivisions.

“Obviously with the lack of market on the sales side, those who would continue to develop are now looking on the side of rentals,” he said.

Mixed Signals

So, does all this activity mean that the housing market is heating up, at least when it comes to multi-family buildings? That’s not clear.

For one thing, the remarkable 75 increase in multi-family permits is driven largely by a huge spike in June that could be a fluke. That month, 1,562 of them were issued, compared to 509 in May, and the number dropped down to a measly 297 in July.

And even if increasing investment in apartment buildings is a real trend, as many in the industry seem to believe, there’s still the question of whether there are even better deals still to come as prices decline.

Jeff Hall, president-elect of the Worcester Regional Association of Realtors, said he thinks the market has pretty much bottomed out.

“One telltale sign right now is a lot of the savvy investors who have cash, who’ve been watching the market, they’re buying now,” he said.

But Haims said he sees things continuing to decline simply because more and more bankruptcies will dump more buildings on the market.

At the same time, Carmi said the prices he’s seeing now are good enough for him because the demand for rentals is high.

Hayman said he’s sorry in some ways to see the city’s housing stock moving toward rentals since local officials have long tried to support home ownership in the inner city. But he said high-quality rental projects are good for the area too.

“For us it’s a matter of whether they’re quality developers; are they sustainable projects?” he said. “We certainly don’t want any more empty buildings.”

In Fitchburg, another city with a high foreclosure rate, Building Commissioner Michael A. Gallant said he’s happy to see multifamily buildings getting renovated.

He said that in the first nine months of the year developers have pulled 50 to 75 permits for rental units.

“We had hardly any renovations in the previous nine months prior to January,” he said. “We very rarely see major renovations done on multi-families. It’s actually good to see those numbers.”

0 Comments