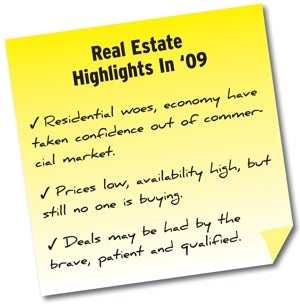

Real Estate Forecast: Brokers Gloomy As Buyers Wait | Residential market dragging commercial sector down

Stark statistics and weary outlooks have become near-permanent fixtures of the real estate industry.

But if you want to see the ravaged market in three dimensions, drive around Worcester’s Webster Square area. You’ll come upon boarded-up houses with overgrown lawns.

“I don’t think anybody envisioned how steep the decline was going to be,” noted Mark LaMountain, vice president of Commonwealth National Bank.

And it appears the commercial market is starting to feel the strain, too. Although local commercial brokers say the market’s been relatively robust beside the residential sag, the recent economic turbulence is projected to cause a slowdown in sales and inventory.

“There’s a lot of fear out there,” said Jim Glickman, principal of Glickman Kovago & Co., a Worcester-based commercial real estate broker. “Whether it’s founded or not, people become nervous.”

Short Sale

Still, despite what seems like a never-ending crisis, there are some glimmers of hope.

Most notably on the residential side: A lower median home price throughout the state — $295,000, down from $340,000 last September — sparked a 5 percent increase in single-family home sales in September 2008 versus September 2007.

“These are very important and healthy indications of activity in the marketplace,” said Jeff Hall, president elect of the Worcester Regional Association of Realtors and a real estate broker with RE/Max Advantage.

He said that he continues to see “multiple-offer scenarios” with some properties. “Things are improving,” he asserted.

Still, it’s hard not to be disheartened by the overall picture.

Massachusetts single-family home sales plunged to a 17-year low during the first two quarters of 2008, according to Boston-based real estate tracker The Warren Group. Sales plummeted 19.1 percent during the first half of the year, the fewest sales for the six-month period since 1991. Prices also dropped 9 percent during the first two quarters.

In the third quarter, the trend continued: Single-family home sales were down 6 percent.

Foreclosures, meanwhile, are still piling up at record rates: In Massachusetts, that meant a 72 percent increase for the first three quarters of 2008 compared to the first three quarters of 2007, according to The Warren Group.

Industry insiders say there won’t likely be a letup on the downward trend until late 2009, and that’s at the earliest. The market simply has to find its bottom. And once it does that, “It has to have a leveling off period,” said LaMountain. That could mean one or two years before things start going back up, he noted.

Buy Worcester Now?

Even so, Hall is optimistic, saying that the market will see “more activity” next year.

All told, he touted the present as the best time to buy; people can afford more home than they could previously. “(Buyers) should see what’s happening now and take advantage of it,” he said.

There are quite a few incentives locally to stimulate that kind of thinking. For instance, qualifying families in certain communities can apply for home repair funds through community development block grants. First-time homebuyers also have assistance opportunities through MassHousing, as well as at the town and city level. In Worcester, that includes Buy Worcester Now, a private/public partnership of 15 banks and credit unions that offers loan programs with below-market interest rates and no or low down payments.

“It’s a total community commitment to help get properties back on the tax rolls,” said LaMountain.

Still, he added, this crisis isn’t just about people not being able to pay mortgages. Many have stretched themselves with high car loans or other expenses; others have been rocked by unemployment or medical conditions. As a result, he’s seen moms and dads moving back in with their sons and daughters, and conversely, kids boomeranging back to the nest.

“We still have to get our hands around this thing,” he said.

Stages Of Grief

To do so, the surplus inventory, including foreclosed and boarded-up properties, has to sell off, and sellers have to be realistic. Hall acknowledged that over-priced properties “just sit there.”

“A lot of sellers are in denial,” he said.

You could say just the opposite of the commercial side of things. Business owners seem to be keeping an acute and calculating watch on the economy.

According to the MIT Center for Real Estate, the demand index for institutional commercial properties fell 3.5 percent in the third quarter of 2008, continuing a downward trend from its 20.3 percent peak in the second quarter in 2007.

Ultimately, the commercial market hasn’t experienced “anywhere near the pressure” of the residential side, according to Glickman.

John McKinley, president of Kelleher & Sadowsky Associates in Worcester, added that commercial prices have appreciated at a much steadier, measured and rational pace, not “boom-bust.”

However, layoffs, increasing unemployment rates and the overall “market panic” on Wall Street have begun to slow things down.

“People’s decision making is going to be very cautious for a time for many sectors,” said McKinley. “Uncertainly is always the biggest enemy of activity.”

To move beyond that takes job and spending security, said Glickman. “Generally people are going to have to start feeling a lot more confident,” he said.

This will be the same formula of success for the residential market. “A lot can be said for consumer confidence,” said LaMountain. “We have to have confidence to pull this thing off.”

Taryn Plumb is a freelance writer based in Worcester.

0 Comments