UniBank CEO sees new career as homecoming

Photo | Allen Jung

Michael Welch, UniBank

Photo | Allen Jung

Michael Welch, UniBank

Michael Welch has now made two 28-hour moves from South Dakota to Central Massachusetts, and each time it was for the opportunity to lead a well-known and respected institution in the region he calls home.

After a career in education administration in two states, Welch became the CEO of Whitinsville-based UniBank for Savings on July 15, replacing former President and CEO Sam Pepper. Christopher Foley, a 33-year banker with the mutual bank since 2000 and the interim president since Pepper’s departure in March, became permanent president.

Welch made the switch to start a new career in a whole new industry, to be closer to aging parents and to come home.

“I’m a Worcester kid,” he said.

A career switch

Welch was educated at Saint John’s High School in Shrewsbury, and it wasn’t long before he found himself pursuing a career in a Catholic education.

His undergraduate work at Marquette University in Wisconsin was soon followed by masters degrees in pastoral ministry and secondary administration at Boston College.

His first job in education came in the 1980s at the Red Cloud Indian School in South Dakota.

“I went out there for what I thought was a year,” he said. “That turned into 10 years.”

The school, located in Pine Ridge, is in one of the poorest areas of the country, Welch said.

“For me, life is about service,” he said. “It’s not about work or a job; it’s about serving the community where I live.”

Welch was promoted to director of development in 1995 and spent two more years in South Dakota before making the first of two trips back to Massachusetts, where he took the assistant principal job at Xaverian Brothers High School in Westwood.

After four years, Welch made what was then the most important career change of his life, to become headmaster at Saint John’s High School, a position he held for 15 years.

While there, Welch oversaw successful capital campaigns to fund renovations and new construction while keeping tuition increases around 3.5% at a time when similar schools were raising fees as much as 7%, he said.

Under Welch’s watch, Saint John’s landed its first gift of more than $1 million.

“We built excitement around the mission of the school,” he said. “People believed in what we were doing and sacrificed to be a part of it.”

In 2016, Welch went back to Red Cloud Indian School in South Dakota to serve as a special assistant to the president, before leaving again this year to be closer to home in Central Massachusetts.

Split duties

When word of Welch’s return to Central Massachusetts reached UniBank’s board – which includes Saint John’s alumni – the directors began to envision a different type of leadership structure.

Welch’s return sparked an interesting idea: What if the directors could convince Welch to become the face of the bank and oversee the organization’s big-picture trajectory while Foley handles the banking side of things?

“It just began to fall into place,” said UniBank Chairman Timothy Wickstrom. Welch “has all the great traits of a leader: honesty, integrity, communication skills and the ability to inspire people to do their best.”

Meanwhile, Foley has as firm a grasp on the banking side of things as anybody in the business, Wickstrom said.

Foley has been with UniBank for nearly 20 years, first as senior vice president and then executive vice president before taking the interim job in March.

“We saw a terrific candidate there for at least part of the top spot,” Wickstrom said. “We considered various options, but it became very clear very quickly that Chris could do exceptionally well in the role of president, so we were really looking for more of a leader than necessarily a banker.”

Welch, who called his counterpart Foley a banking rockstar, will head up the organization’s outward-facing business model, relationships with local businesses, institutions and the community.

“His expertise in banking allows this paradigm shift to occur,” Welch said of Foley.

Pepper’s quiet departure

The idea to install a two-headed leadership team at the bank was made possible only when Pepper agreed to step down in March.

That move was without any news whatsoever. The bank’s annual report from 2018 made no mention of Pepper.

Pepper took the job in 2017, coming from Kansas, where he was executive vice president and commercial banking president for Equity Bank. Before that, he worked at Enterprise Bank & Trust and at BMO Harris Bank in Missouri.

However, after Pepper’s first 22 months at UniBank, Wickstrom and the board decided he wasn’t the right fit.

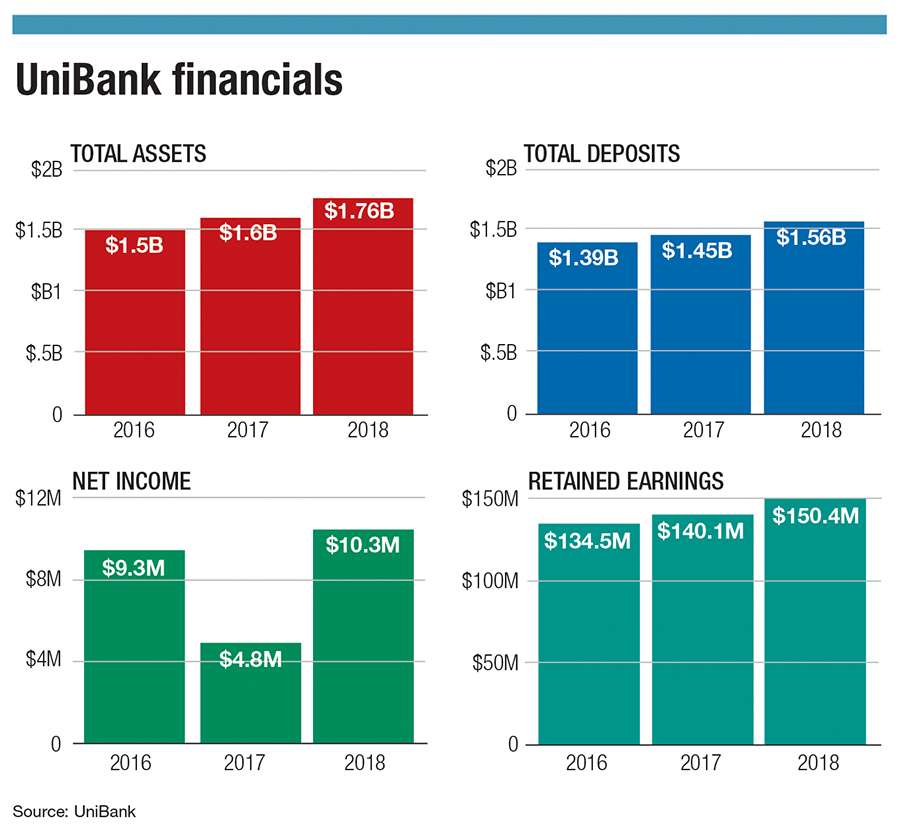

“The growth in the bank’s numbers wasn’t what we had hoped they would be in 2017 and 2018,” Wickstrom said.

Pepper could not be reached for comment.

Without getting into details, Wickstrom made reference to adjustments that needed to be made due to the Tax Cuts and Jobs Act signed into law in December 2017, that reduced the corporate tax rate from 35% to 21%.

The law led to a one-time tax charge of $3.6 million and reduced UniBank's after-tax net income from $12.1 million to $4.6 million.

According to the bank’s annual reports, the bank’s assets went from $1.53 billion in 2016 to $1.6 billion in 2017 and $1.76 billion in 2016, increases of 4.5% and 9%, respectively.

Net income fell from $9.24 million in 2016 to $4.6 million in 2017. In 2018, it rose back to nearly $10.3 million.

0 Comments