A Taxing Choice | Retailers are conflicted over whether to support a sales tax rollback

On the one hand Robert Boyle, regional manager of New England furniture retailer Stickley, Audi & Co. in Natick, would love to see the state sales tax reduced.

After all, a reduced sales tax would encourage sales at retail stores, as evidenced by a recent sales-tax holiday that brought a spike to business.

But Boyle is worried about Question 3 on the Nov. 2 ballot this year, which would cut the state sales tax from 6.25 percent to 3 percent, and specifically what sort of cuts its passage may mean to state and local government.

Boyle is like many business owners: Excited about the positive effects reducing the sales tax could have, but worried about the collateral damage caused by cuts in funding.

“I’m really struggling with how I’m going to vote,” he said.

Cutting Back

Reducing the state sales tax by more than 50 percent would cost the state anywhere from $2.3 billion to $2.5 billion in revenue, according to estimates. Some economists say part of that could be made up by additional consumer spending because the sales tax is reduced, however.

Proponents of the question say that the cuts can be made up without touching local aid to cities and towns or education funding.

Opponents, including Associated Industries of Massachusetts, the statewide business advocacy group, worry about the drastic revenue shortfall passage of Question 3 would cause.

“It would require huge cuts in support for education, health care, transportation, public safety, human services and a host of other programs that are critical for the future of the Massachusetts economy,” said Michael Widmer, president of the Massachusetts Taxpayers Foundation, a non-partisan independent budget and policy group in Boston. “It’s a gargantuan hole that comes after three years of budget cutting.”

The impact of cutting about $2.5 billion in revenue would be exacerbated by the expiration of federal stimulus funds, he said. The state has relied on those funds to avoid cuts.

Even without a cut in the sales tax, the state is already facing a $2-billion budget deficit because of regular cost increases in areas such as health care and salaries.

For cities and towns, Widmer said he expects passage of Question 3 would undoubtedly mean layoffs.

Small-government proponents of the ballot question, not surprisingly, disagree.

Finding Waste

Carla Howell, director of The Alliance To Roll Back Taxes, said about $2 billion can be cut out of the state’s estimated $54 billion in spending without touching local aid, education, human services, or other state and local programs.

The organization’s website, www.rollbacktaxes.com, has a list of dozens of examples of state programs that can be cut and areas of wasteful spending. Many are investigative reports by media organizations that have shown abuses of public funds. Others are examples of long-standing initiatives, like pension reform and union salaries. Other examples range from disbanding an environmental police force to scrapping a memorial for former U.S. Sen. Edward Kennedy, which has an estimated cost of more than $60 million.

Howell said she has not totaled the proposed cuts to see how much they would be worth, and many of the cuts would require legislation, negotiations or other changes to be implemented.

The alliance unsuccessfully ran bids in 2002 and 2008 to repeal the state income tax.

Other economists supportive of the plan claim that rolling back the sales tax would create jobs in the private sector. David Tuerck, for example, is chairman of the economics department of Suffolk University in Boston and executive director of the Beacon Hill Institute, a free-market, small-government research group affiliated with the university. He estimates that passage of Question 3 could create up to 33,000 new private-sector jobs. Increasing the sales tax two years ago from 5 percent to 6.25 percent cost the state about 10,000 jobs, he said. So, reducing the sales tax would have the inverse effect. And that’s not even mentioning the impact on consumer spending.

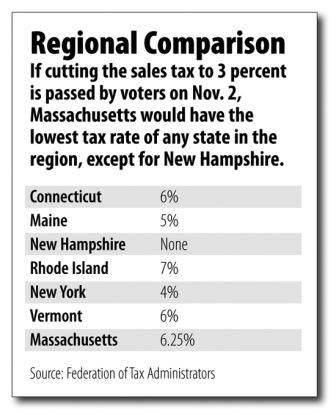

“This would make our retailers incredibly more competitive with respect to New Hampshire, Rhode Island and New York,” he said. “It would be quite a stimulus to the retail sector.”

New jobs in the retail sector, he said, will lead to more Massachusetts residents spending money in the state.

The Associated Industries of Massachusetts, for example, recently decided to oppose the ballot question, according to Brian Gilmore, the group’s executive vice president of public affairs.

“The financial impact of the passage in the first year would be tremendously difficult to overcome,” he said.

One of the most important things for businesses is having predictability in terms of government taxes, he said. While the tax rollback may be attractive for some businesses, it’s unrealistic the state would be able to cut $2 billion to $3 billion without raising additional revenues elsewhere, he argued. Having a large unknown as to what other fees would rise is “not conducive to an environment for making new investments.”

For other business owners, supporting the law is extremely tempting.

David Didriksen owns Willow Books & Café in Acton and wants to “send a message” to Beacon Hill legislators.

“As a retailer, the sales tax definitely affects our sales,” he said. “There’s no question that consumer spending has been dampened because of the increase in the sales tax.”

But, as a resident of Acton, he’s worried about municipal services being cut in the police, fire and education systems.

“I’m really against the whole idea of a sales tax,” he said. “I think it’s the most unfair tax there is, but I just don’t know if this is the solution.”

0 Comments