Coworking spaces and the coronavirus pandemic were never going to be a great match.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Coworking spaces and the coronavirus pandemic were never going to be a great match.

Such spaces bring people together under a single roof where they can share common spaces and maybe benefit from sharing ideas with one another. The pandemic made all of that inadvisable.

The pandemic, though, may be putting coworking spaces and similar uses like incubators – all often open 24/7 for members to use – in a better position once the public health crisis has passed.

A few reasons may account for that, Central Massachusetts industry leaders say. Some have found themselves with more free time or spare money than they had before the recession. Others, forced or pre-emptively looking to change careers, are looking for a small, affordable space. A number of companies have or are expected to opt out of office leases and instead take up a coworking space membership for occasional staff meetings.

“Here’s the silver lining in the pandemic,” said Randal Meraki, the owner of WorcShop, an incubator, training and coworking space in Leicester. “It creates the opportunity for our region to re-engage in the innovation economy.”

The years leading up to the pandemic saw a boom in coworking and incubator space in Central Massachusetts and far beyond. Locally, WorcShop, Technocopia and Quinsigamond Community College’s QuEST Center joined the trend, among others, as the cost savings of sharing space and equipment became apparent, as well as the intangible benefits of having people share know-how and ideas with one another.

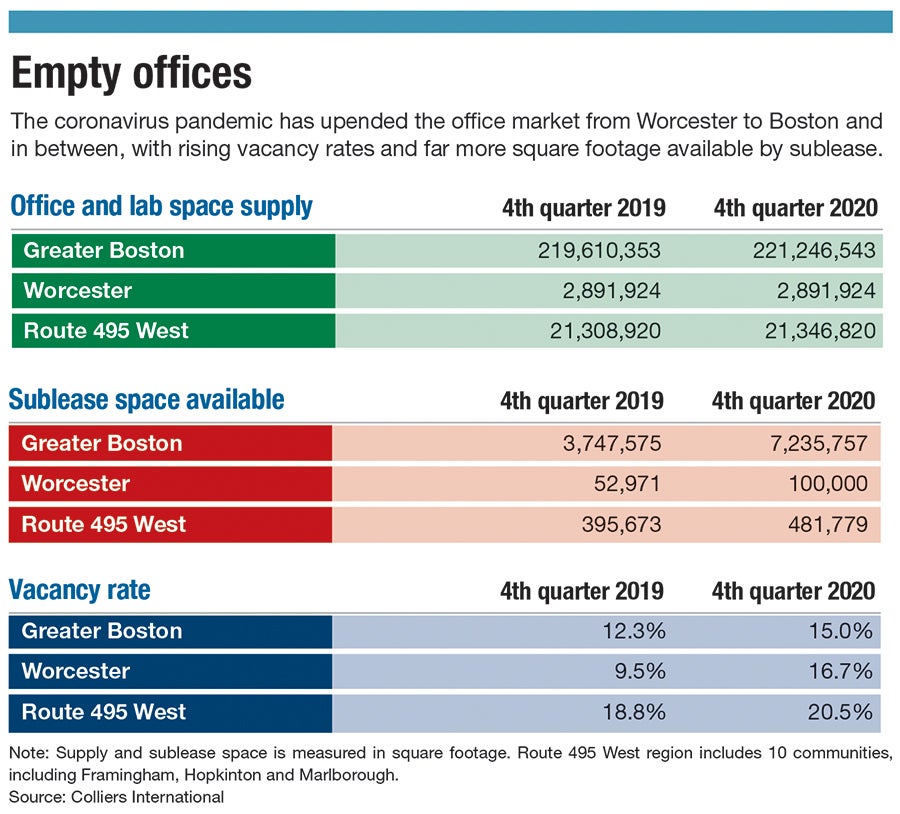

It isn’t that coworking spaces haven’t taken a hit during the pandemic. They’ve seen plummeting usage rates just as office vacancies and subleases have skyrocketed. Like offices, they’re also subject to state rules sharply limiting capacities for health safety.

The industry tracker Research and Markets projected last June the coworking market would shrink in 2020 at an annualized rate of nearly 13%, but then recover at an annualized growth rate of 11.8% through 2023.

The pandemic dip

At the Marlborough co-working space Venture X, occupancy fell from 80% before the pandemic to 35%. At Technocopia in downtown Worcester, where most of the 11,000 square feet of space in the Printers Building is wide open, a 25% capacity limit means the staff needs to keep attendance logs to figure out how many are there – and, sometimes, who might need to leave.

WorcShop has had fortuitous timing with the pandemic’s complications and limitations. The facility was already planning a move from Stafford Street to the site of the old Worcester Tool & Stamping Co. in the Rochdale section of Leicester. Last fall, it began a partnership with SMGraves Associates allowing it to expand its educational offices.

“We became available at the same time they became available,” said Scott Graves, the owner of SMGraves Associates, which was formerly involved with the Wachusett Business Incubator in Gardner.

“That was a very happy accident,” Meraki said of the timing.

These days, Meraki and Graves are among the leadership team working to renovate 52,000 square feet of old mill space to again provide WorcShop members with metal fabrication equipment, 3D printers and the like – and ultimately, they hope, 40 or so residential units for members.

The expected rebound

Even as coronavirus cases have been around all-time highs in Massachusetts in January, these spaces are already seeing signs that make them bullish about the post-pandemic future of strangers sharing space in close quarters.

At Venture X, occupancy has bounced back some to reach 50% from 35%. Its single- and two-person suites have sold out. In fact, Ryan Gagne, the franchise owner of the location, is considering subdividing larger offices into smaller ones to take advantage of the shift.

“We are seeing a resurgence in interest,” Gagne said.

Why? Some industries are seeing lost productivity since employees began working remotely and lost an ability to interact and collaborate with each other, Gagne said. In other cases, employers that don’t currently have offices need a spot to train new workers.

A location such as Marlborough can capture a share of Boston companies, for example, wanting to open small suburban outposts where workers could gather in smaller groups.

At Technocopia, President Lauren Monroe has fielded so many inquiries about new memberships she says she can’t keep up. That’s despite safety-related moves including trimming some programming and lessening recruitment efforts.

“For us, it was an opportunity to focus more on membership and retainment, and less on recruitment of new members and selling classes to the public,” Monroe said.

At $75 a month, Technocopia is affordable for most, and its membership stands at about 115, which includes about 30 who are most active. Monroe attributes the interest to a growing entrepreneurial wave that’s accompanied pandemic-related turmoil that’s hit virtually every industry.

“I don’t know what surprises me anymore,” she said of the surge in interest despite so much health and economic uncertainty. Many newcomers have stories that are generally something like “I’ve always wanted to…”

“People are recreating their lives,” Monroe said.

WorcShop, which is still looking to raise money from public and private sources for most of its roughly $3.5-million renovation, has kept much of its 85 members from before shutting down. Eventually, it hopes to get to more than 200 within a year of reopening sometime this summer, Meraki said.

WorcShop has had the benefit of sorts of renovating at a time when its members couldn’t be working together in large numbers anyway, and with the new involvement of SMGraves Associates, will have what Meraki describes as roughly an even mix between maker space, business incubator and workforce training, the last of which is done with public partners including MassHire and MassDevelopment.

“This project is enormous, and will have an enormous impact on the region,” Meraki said confidently. “The future looks bright, despite the pandemic.”