After a ballot initiative to legalize medical marijuana was approved by Massachusetts voters in the 2012 election, finding a bank that was willing to provide services to a cannabis business was a bit like trying to buy marijuana before it was legal.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

After a ballot initiative to legalize medical marijuana was approved by Massachusetts voters in the 2012 election, finding a bank that was willing to provide services to a cannabis business was a bit like trying to buy marijuana before it was legal.

To put it simply, you had to know someone.

After the election, It quickly became apparent that the results didn’t end the uncertainty and stigma surrounding the substance.

Cannabis businesses faced a struggle to find a bank that would be willing to work with a company that sold a federally illegal drug. For years, only a single bank in Massachusetts - Century Bank in Medford - was quietly taking on cannabis clients.

Dispensaries that could even find a bank willing to consider taking their money often faced high monthly fees just for having an account, a side effect of the fact that banks are required to go through the laborious process of filing a suspicious activity report with federal regulators for every marijuana-related deposit.

The lack of banking options clearly didn’t slow down the cannabis industry. In the years that have followed full legalization, at least 12 Massachusetts-based banks have entered the cannabis space, according to a review of publicly available information conducted by WBJ.

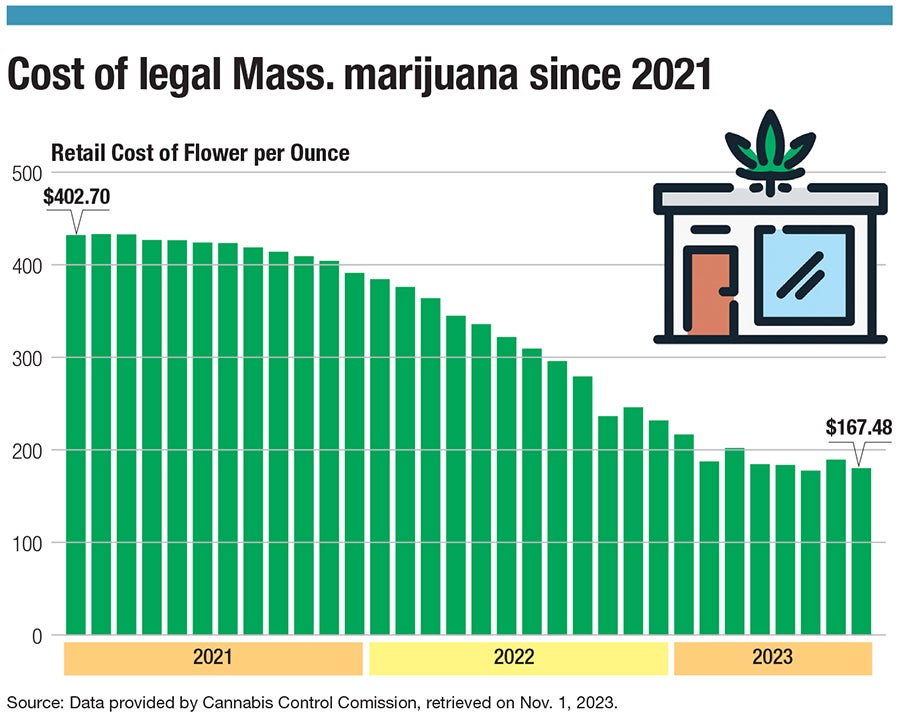

Even with the new competition, there’s still a lot of cash to go around: Combining both adult use and medical sales, companies sold approximately $152.8 million worth of marijuana this September, according to data provided by the Cannabis Control Commission.

Major improvements

Those who have been in the space for a while are not exactly nostalgic about the early days of cannabis banking.

Ulysses Youngblood, founder and president of Major Bloom dispensary in Worcester, remembers having his personal account with a large bank shut down after using it to fund some expenses while the business was still in its planning stages.

Financial institutions who were willing to play ball with marijuana companies weren’t being much friendlier.

“I remember going to Century Bank and seeing a $5,000 monthly fee,” he said.

Today, things are a lot different, as banks are actually seeking him out to see if they can obtain his business.

“Banks are trying to be innovative now,” said Youngblood, noting that his current provider has dropped its fees, “I often get representatives from other banks hitting me up.”

Still, things are far from perfect, as federal illegality continues to throw obstacles at the feet of cannabis business owners.

Youngblood described the current process that Major Bloom has to go through to deposit cash as clunky, as it is complicated by the fact that cash-in-transit service providers who are federally insured often refuse to work with cannabis companies.

But even with the headaches, at least operators in the space now have no shortage of local banks who are willing to accept their business.

One of the institutions that has jumped into the cannabis space is Marlborough-based Main Street Bank, which has 25-30 cannabis business clients.

The bank waited until 2019 to get into the space. Making sure existing customers and employees were comfortable with the move was a key factor, according to Renee Jaworek, vice president of MSB’s bank secrecy act department, which handles cannabis transactions.

"I think reputational risk was one of the biggest concerns of the board. It was still quiet,” she said, “Even when I went to compliance seminars, no bank in the room would raise their hand and say that they were in the cannabis space yet."

Entering the sector has led to dealing with business owners who are a bit more eccentric than the average customer. That makes the regulatory burden a bit easier to tolerate, according to Brandon Curran, MSB’s vice president of cannabis banking.

"I get to deal with a lot more unique, fun people. I get to know someone who's running a cannabis store rather than someone who is a financial advisor on Wall Street,” he said.

Guidance through compliance

Central Massachusetts is also home to the first institution to offer financial services to adult-use cannabis businesses: Lighthouse Biz Solutions, a subsidiary of Gardner’s GFA Credit Union.

When Century Bank — which has since merged with Boston’s Eastern Bank and stopped offering cannabis banking — decided they weren’t going to accept clients selling recreational marijuana, GFA saw an opportunity.

Being the first mover has allowed the bank to accumulate a large portfolio of cannabis clients, according to Melissa Maranda, president of Lighthouse.

The company tries to make banking a straightforward experience for cannabis customers, even if it’s anything but that from a compliance perspective.

“We do our best to make these accounts feel as normal as we can,” she said, “but for our cannabis clients, on the backside, there’s nothing normal about them.”

It’s easy to forget that all this economic activity is in direct violation of federal law.

“Here in Massachusetts, cannabis is legal and it’s no big deal. In reality, you are technically breaking federal law every single day,” said Maranda, noting that she receives a few calls a week from people she believes are attempting to use the bank to launder money from the illicit cannabis market or other illegal activities.

Banks get creative

MSB has worked to find ways to reduce any regulatory burdens on cannabis customers.

"That was a big piece when we got into the space, that there were pain points that we heard from cannabis customers that other financial institutions were making them do manual uploads of all their income and sales data," said Jaworek.

Companies have begun to try to find solutions to the mountains of compliance-related work. Many banks utilize the services of Green Check Verified, a fintech firm headquartered in Florida.

The company has over 153 different banks and over 8,000 businesses on their platform, according to company founder and CEO Kevin Hart. Their platform allows for banks to look at every transaction to ensure compliance by allowing technology to do the heavy lifting.

“It’s a complex weave of plumbing and infrastructure of data and money moving back and forth between all the nodes and pieces,” said Hart.

As long as cannabis remains federally illegal, it’s likely that banking cannabis will remain a unique challenge.

But there is pending legislation in Congress that supporters say could improve the situation: The Secure and Fair Enforcement Regulation (SAFER) Banking Act.

The purpose of the legislation is to prohibit federal regulators from punishing banks for conducting transactions with state-legal businesses.

First introduced in 2017, previous iterations of SAFER have made it through the House, but have never been passed by the Senate. This year, ongoing wars and congressional leadership changes have potentially once again sunk any chance of passage.

Local options grow

Despite the lack of reform, local banks continue to increase the amount of services that are available to cannabis clients, including the chance to receive loans, a big development for an industry that has historically lacked access to traditional forms of capital.

MSB offers cannabis companies loans that range from $100,000 to $10,000,000, helping businesses with everything from working capital to real estate and equipment purchases, according to Curran.

"It used to be that we would not lend to cannabis companies directly,” he said.

The scrutiny that is required of cannabis accounts has the unintended benefit of giving banks extra insight into the well-being of the potential loanees, according to Hart.

“When you can look at the financial health and performance of a cannabis business and see it at a single dollar level day in and day out, you have more visibility into the health of a cannabis business than you do any other commercial account,” he said.

The competition between banks has also led to a decline in fees.

"Massachusetts is a real trendsetter when it comes to the cannabis industry," said Hart. "They were one of the first states where not only one, but multiple financial institutions went to zero fees for cannabis banking. That's a bellwether event."

While the reduction in fees is newsworthy, Maranda is quick to remind the industry that compliance remains the most important factor.

“I get a little nervous when I hear banks say that they’re going to do this work for free,” she said, “It makes me wonder if they understand the compliance burden they’re taking on.”