Healey plan reopens tax debate in legislature

Photo | Courtesy of State House News Service

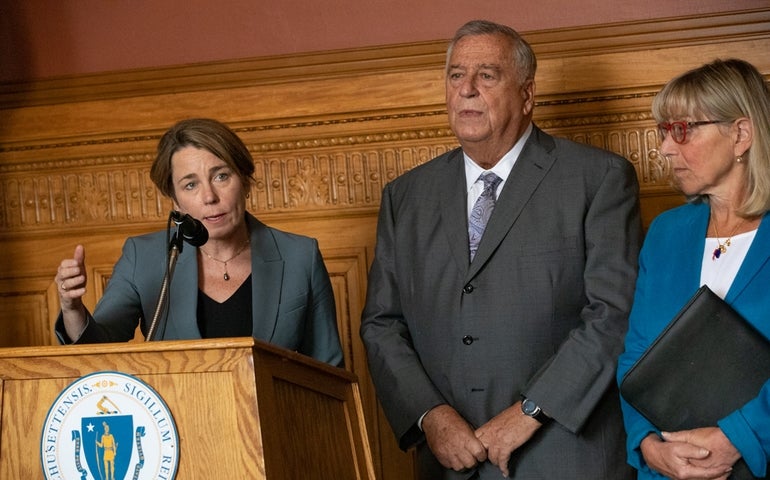

Gov. Maura Healey speaks to reporters alongside House Speaker Ron Mariano and Senate President Karen Spilka.

Photo | Courtesy of State House News Service

Gov. Maura Healey speaks to reporters alongside House Speaker Ron Mariano and Senate President Karen Spilka.

Massachusetts lurched back into the tax debate on Monday as Gov. Maura Healey unveiled details of a relief package whose cost could swell to nearly $1 billion per year, giving lawmakers a menu to add or slash from in the coming months as they wade back into a topic they spurned last summer.

Flanked by caregivers who would receive hundreds of dollars more in their pockets under the proposal, Healey and Lt. Gov. Kim Driscoll ventured to the Demakes Family YMCA in Lynn to outline their tax relief proposal that will feature alongside the administration's first state budget bill due Wednesday.

Healey pitched the measure, which combines relief for caregivers, renters and seniors with substantial estate and capital gains tax reforms long sought by business leaders, as the "start of a conversation," and she signaled an openness to other ideas that faltered last year.

The new corner-office duo again observed that Massachusetts is growing unaffordable for many of its residents and falling behind other states that offer a more attractive environment for businesses, arguing that the combination of tax code changes they offered are necessary to address both problems in one swoop.

"We're really ready to get this done," Driscoll said.

[Read: Healey Administration's Official Tax Relief Summary]

The "hallmark" of the package is a new, streamlined credit for parents and caregivers, which would give taxpayers $600 per year for each dependent including children younger than 13, disabled adults and seniors. That would apply to about 700,000 taxpayers who care for more than 1 million dependents.

Rosario Ubiera-Minaya, the executive director of Raw Art Works in Lynn who joined Healey and Driscoll at their press conference, described the challenges she faces caring for her 89-year-old father, who was diagnosed with Alzheimer's 10 years ago.

"Everything has been going up -- groceries, medicine, gas, housing, and it has been difficult to figure out how we're going to keep up every month. If that's the case for us, I cannot even imagine what's happening with other families that don't have a steady income or a two-income household," Ubiera-Minaya said.

"Things piled up quickly and constantly, and it's hard to prioritize and keep up," she added. "My dad needs us, and we are in the midst of navigating a complex system of elderly care and support here in Massachusetts. This is something that is certainly keeping us up at night, and I'm just one of the many stories of individuals like me, like my husband, who are coming into the stage in our lives when we are faced with aging parents and their needs."

Other targeted relief in the proposal includes doubling the senior circuit breaker credit, which would give taxpayers who are eligible for the maximum credit an additional $1,200 back, and increasing the cap on the rent deduction from $3,000 to $4,000, which would amount to about $50 more per renter.

Healey included two major changes long sought by the region's business leaders. Her proposal would effectively triple the threshold at which the estate tax kicks in, from $1 million to $3 million, while offering $182,000 in relief to larger estates. It would also slash the short-term capital gains tax rate from 12 percent to 5 percent, aligning it with the levy applied to long-term capital gains and most other income.

Healey said Massachusetts ranks as an "outlier" on its estate and capital gains taxes: only 12 other states tax estates at all, and only Oregon shares a threshold as low, while Wisconsin and South Carolina are the only two other states that subject short-term capital gains to a higher tax rate than long-term capital gains.

"When we don't keep up with other states, you see, we put our own competitiveness at risk. It drives our businesses and our residents out of the state," Healey said.

Altogether, the package would carry a gross cost of $859 million in fiscal year 2024 and $986 million on an annualized basis. The Healey administration said its net cost would be $742 million in FY24 and $869 million annually, arguing that roughly $117 million in foregone capital gains tax revenue could not be spent as part of the budget because that money will likely be required to be placed in reserves, not spent directly.

Beacon Hill budget-writers project that Massachusetts will collect more than half a billion dollars of capital gains tax revenue above an allowable cap, and overages must be put in savings. Capital gains revenues can be volatile, though, so an unexpected plummet in that arena could lead to a budgetary hit.

With Healey's proposal now out in the world, attention will turn to how House and Senate Democrats will navigate key pressure points such as whether to embrace the latest capital gains reform effort, revive an earned income tax credit expansion or reduce the overall income tax rate.

It remains unclear whether legislative leaders will react with urgency or, after they smothered their tax relief legislation last fall once the obligation to repay taxpayers nearly $3 billion became clear, stymie a governor's proposal for the second straight year.

House Speaker Ron Mariano and Senate President Karen Spilka offered few specifics about their approach, saying Monday that they like some of the ideas Healey put forward but need more time to parse the details.

"There's a lot of pieces in the governor's proposal that are close to what the Senate endorsed. We will certainly be taking a look at that, in particular the child care and dependent tax credit," Spilka said, calling herself "very pleased" by the overall package.

Shortly after appearing alongside Mariano and Healey, Spilka put out a statement via her spokesperson saying that she had "consistently stated my support for permanent progressive tax relief" and "look[s] forward to continuing this conversation with my Senate colleagues and partners in the Administration and the House so that we can move forward with tax relief soon this session."

Both branches last year agreed to several tax proposals, including some floated by Gov. Charlie Baker, but ultimately scrapped their efforts after it became clear the state owed taxpayers nearly $3 billion after triggering a long-dormant tax cap law known as Chapter 62F.

Mariano, who said this month he believes the "situation has changed" since the Legislature's summertime interest in tax relief, told reporters he thinks Healey's proposal has "some good things in there, things that we supported in the past, and there are things in there that are new to us."

Whether Healey's measures do enough to address affordability concerns "remains to be seen," Mariano said.

"I was reluctant to embrace too many changes in the tax code when we were under the previous governor because we had the 62F and tax package, and we were coming into an uncertain economy with an inflation rate still going up. No one seems to be able to control the inflation rate. The feds have moved the interest rate a couple of times," Mariano said Monday. "Other decisions we're going to make, and I speak only for the House, are going to be based on how we view the economy going forward and what's in this package and what can benefit the most folks that we represent."

Some progressive Democrats voiced frustration that Healey did not suggest an expansion of the earned income tax credit that supports low- and moderate-income workers.

Both the House and Senate initially approved expanding the EITC last year before their tax-relief retreat. Spilka on Monday said research indicates that credit "is one of the best ways to get money in the pockets of low-income people."

If legislative leaders make another bid to resurrect the idea, they might find Healey to be a willing partner.

"Nothing is off the table," the governor said Monday when asked if she would support increasing the EITC or offering one-time tax rebates, another idea lawmakers pursued last year. "We went with the child tax credit because we believe that it would cover more families, more residents. But I think anything that gets at affordability right now, that gets at driving down the high cost of living for residents around the state, that will incent more people to come here, to stay here, to grow families here, to go to school here and stay here, to grow businesses here -- that's where we want to be."

The business-friendly tax code changes in Healey's plan also quickly drew criticism from some members of her own party and from the Raise Up Coalition, a group of labor unions and community groups that led the successful ballot question campaign imposing a higher tax rate on household income over $1 million.

While calling the child and family credit and relief for renters and seniors "progressive policies that will make our state more affordable for working families," the coalition said in an unsigned statement that its members think her estate and capital gains changes "would deliver an enormous windfall to the richest members of our society, while depriving the state of hundreds of millions of dollars in much-needed revenues."

"The proposed changes to the estate tax would give a few thousand of the wealthiest families in the state a six-figure tax cut, while the cut to the short-term capital gains tax rate would reward wealthy day traders and real estate speculators for their risky financial maneuvering," the coalition said. "A solid majority of the voters in November chose a fairer tax system that raises more than a billion dollars in new annual revenue. A billion-dollar permanent tax cut, including these two incredibly regressive policies, would undermine those goals while placing the state at risk for catastrophic budget cuts in future years."

Business groups, meanwhile, looked favorably on the estate and capital gains reforms that resurfaced in Healey's package, even as they called for expanding its scope.

Greater Boston Chamber of Commerce President and CEO James Rooney, whose group previously endorsed additional ideas like reforming the "sting tax" applied to S-corporations with gross receipts over $6 million, called the governor's plan "a good first signal that the administration will work with the business community."

"However, there remains much work to do to restore Massachusetts' competitiveness to keep residents and businesses here, and we look forward to working with the legislature on this tax package and the budget in the coming months," Rooney said in a statement. "With a state budget that increased by $10 billion -- 25% -- in just four fiscal years because of private sector wage growth, policymakers must find meaningful ways to continue to support the region's employers as they seek to stay and succeed here."

House and Senate leaders left Baker's similar proposal to slash the short-term capital gains tax out of their ultimately doomed reform proposals, and senators along the way rejected a Minority Leader Bruce Tarr amendment that would have added that language. Spilka did not mention the capital gains tax in her statement on Monday.

Healey's proposal does not seek any change to the state's 6.25 percent sales tax nor its 5 percent income tax, the latter of which is a target of groups such as the Associated Industries of Massachusetts, particularly now that the state also features a voter-approved 4 percent surtax -- which Healey supported and most business groups opposed -- on household income above $1 million.

The right-leaning Massachusetts Fiscal Alliance said Monday it views slashing the income tax as "the single best way to keep Massachusetts competitive."

"Reforming the estate tax, as well as her proposed reform of the short-term capital gains tax, in which we are also an outlier, are both helpful moves," said MassFiscal spokesperson Paul Craney. "Ultimately, Massachusetts will still need bolder action if we're to mitigate some of the damage done by the passage of Question 1. There are 32 other states in this country without any form of estate or inheritance tax and we should be following their lead in order to keep taxpayers in Massachusetts."

Connecticut Gov. Ned Lamont wove a state income tax reduction into his budget proposal, proposing the first cut since 1991, according to the CT Mirror.

Boston Mayor Michelle Wu was asked Monday on WBUR about Healey's tax package and specifically the proposal to increase the rental deduction annual cap from $3,000 to $4,000, but the mayor said she had not seen any of the plan's particulars.

"I know this was a campaign promise of hers and so it's great to see follow-through. I don't know how all the pieces add up all together, but certainly families are struggling and need relief and our tax code is one way where we can provide that targeted relief," Wu said. "I do know that we also want to ensure that there are revenues left over for the long-term planning and infrastructure, that transportation and education and all of those priorities that sometimes have been underfunded because they are more long-term -- part of what passed over the last year with the Fair Share Amendment was to dedicate funding for those priorities and so hope to see how all those pieces fit together."

The relief Healey proposed will be funded in the fiscal year 2024 state budget she plans to unveil Wednesday, and the administration has made a point to float several central components of its first annual spending plan ahead of that date.

In addition to the $742 million net cost for tax relief in FY24, Healey's team also announced last week it would propose a $635 million or 8.2 percent increase in overall local aid, including a massive $586 million boost in Chapter 70 education aid that represents full funding of the 2019 school finance reform law known as the Student Opportunity Act.

Those two measures alone would carry a total impact of about $1.38 billion.

Other investment increases are likely to feature in the full budget bill later this week, according to Driscoll.

"Over the next several days, we'll be detailing the full scope of our budget proposal for the next fiscal year. That's going to include significant investments in workforce development and education beyond our K-12 system -- early ed, higher ed, transportation, investments to meet our climate goals," she said. "For us, budgets are really a value proposition. It's a statement. It's about making our state more affordable with these tax reductions. That's part of the whole package."

The administration and legislative budget managers agreed in January to assume they will have $40.41 billion in general tax revenue to spend in FY24, about $642 million than the revised FY23 amount, plus another $1 billion in surtax revenue designed to fund transportation and education investments.

In recent years, Beacon Hill ended with huge surpluses after collecting far more tax revenue than budget-writers expected and struggling to spend it all quickly.

0 Comments