Fueled by the demand for distribution space to fulfill burgeoning online sales orders, the Central Massachusetts’ industrial market was among many regions in the U.S. to reap the benefits last year.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Fueled by the demand for distribution space to fulfill burgeoning online sales orders, the Central Massachusetts’ industrial market was among many regions in the U.S. to reap the benefits last year, according to a report by Cushman & Wakefield, a global commercial real estate company.

Internet retail sales in the U.S. reached $365 billion last year, up nearly 16% over 2018, and by 2024 e-sales are expected to reach $600 billion, according to Statista, an online data company.

That’s good news for industrial and warehouse owners who saw rents rise, making them very attractive to investors looking to buy.

“The demand for very modern, high-bay distribution space is very strong,” said James Umphrey, a principal at Kelleher & Sadowsky, the Worcester commercial real estate brokerage. “It’s clearly being driven by rising internet sales.”

As a result, year-over-year industrial rents for much of the industrial space has risen by more than 11%, Umphrey said.

One year ago, the average per-square-foot rent for warehouse was $6.75 per square foot. Today, it’s fetching as much as $7.50, he said.

Cushman said two kinds of industrial space are doing well: Distribution centers where products are received and distributed; and fulfillment centers where items arrive in bulk, are broken down, and shipped.

A distribution hotbed

Demand has risen high enough some warehouse space is even being built on spec, the industry term for when a tenant isn’t yet lined up.

That was the case for a $30-million, 345,000-square-foot distribution facility in Bellingham where construction began in November. The new facility at 160 Mechanic St., called Lincoln Logistics 36, is expected to be completed by the fall of 2020.

Connecticut financial services firm Barings and Boston property management company Lincoln Property Co. have teamed up for the Lincoln Logistics 36 project.

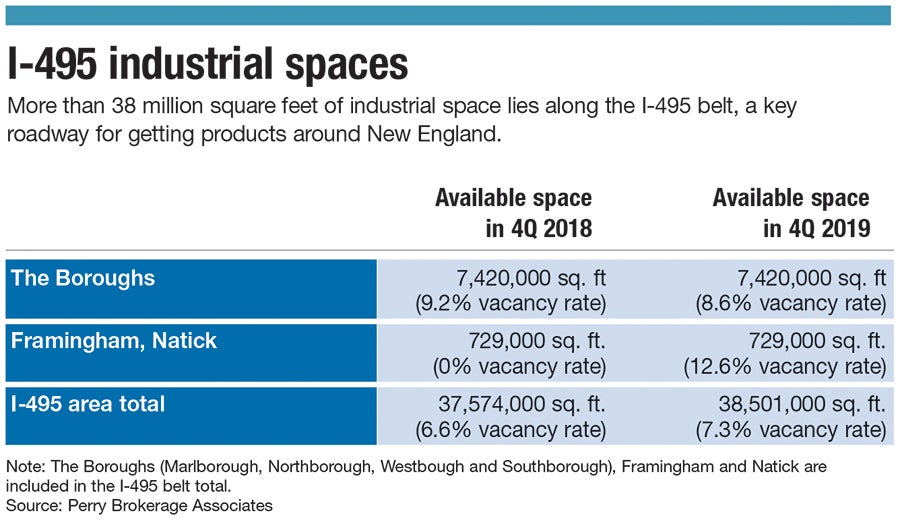

Lincoln Logistics 36 will be in an area of the I-495 belt becoming increasingly popular for logistics.

A Garelick Farms distribution facility is just over a mile to the east down Route 140, as well as the paper distributor Lindenmeyr Munroe, the building material supplier BlueLinx, and the retailer Mattress Firm.

A new facility just over a mile away on Maple Street is shared by the convenience store chain 7-Eleven and the snack maker Snyder's-Lance.

Another on-spec facility opened last year on Bartlett Street in Northborough. The building was 70% leased by the time it opened.

Sale prices for such buildings have soared.

In March 2019, a FedEx warehouse in Natick sold for just under $52 million.

Last May, a Milford warehouse used by Amazon and a communications equipment supplier sold for $33.6 million.

Last fall, a Boston realty group, Marcus Partners, paid $31.6 million for two adjacent warehouses on Grove Street in Franklin.

The other factor making these buildings attractive to investors is companies like Best Buy, FedEx, and Amazon having good credit and typically signing extended-year deals with built-in rent hikes.

“These companies are definitely building big blocks of space,” Umphrey said.

The next wave of retailers who handle multiple products from different companies will drive rents and sales prices.

Potpourri Group built a 450,000-square-foot e-commerce facility in Littleton. The company ships more than 5 million packages annually from the 52-acre site located off I-495’s Exit 30.

The rising demand and selling prices have been attracting big institutional investors, Umphrey said, like the New York Life Insurance Co. and New York investment management firm Black Rock, Inc.

“It is not uncommon for these companies to be paying over $100 per square foot for those buildings in markets like Westbourough and Marlborough,” Umphrey said. “That end of the market is very strong.”

Cushman’s report says economic indicators, with strong links to industrial fundamentals, point to continued growth in 2020 and 2021.

“Industrial has been the investors’ darling in recent years, and there is no indication of this love affair coming to an end any time soon,” the report said. “Over the next couple of years, we expect it to remain one of the leading product types to watch.”

WBJ News Editor Grant Welker contributed to this report.