More than half dozen economists interviewed by WBJ said the cost overruns will make Polar Park far less likely to come close to paying for itself after it opens in 2021.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

When news broke in January about the costs for the new stadium for the Worcester Red Sox being more than $30 million over budget, city leaders were virtually uniform in their response: These things happen in a complicated project.

Sports economists who study these types of municipal projects had the same response – except with a far different tone.

The more than half dozen economists interviewed by WBJ said the cost overruns will make Polar Park far less likely to come close to paying for itself after it opens in 2021, a claim Worcester officials have been steadfast in making, but one economic experts have steadfastly said will never come to fruition.

And the city’s proposed expansion of a special tax district will only further affect the rest of the city’s finances, they said.

The tax district will enable Worcester to collect new taxes and direct them toward paying off the park, but it’ll also take new tax revenues away from the city’s general coffers, which help pay for services throughout the city.

“A lot of the time, these things just draw businesses away from other areas,” said Michael Leeds, an economics professor at Temple University in Philadelphia.

The city has said all along that the ballpark will pay for itself through new tax revenue generated in a special tax district surrounding Polar Park, along with additional revenue like parking fees. The ballpark wouldn’t exist if not for planned new development and vice versa, City Manager Edward Augustus said at a City Council meeting Jan. 14.

“That’s why they’re building hotels across the street,” he said of the ballpark’s impact. “That’s why they’re building housing across the street, and office buildings and retail.”

Augustus called using revenue from new development to pay for the park “the magic of the deal,” and predicted people would come from around New England to spend the weekend in Worcester to see a game.

“The people of Worcester get it,” he said. “They get how consequential it is.”

Reaching for a high bar

But the threshold for a ballpark truly paying for itself is high, industry experts say.

First, related development needs to take place as hoped for, and on schedule. That ensures new revenue that’s relied on to help pay for the stadium costs comes in as expected.

Second, that development would have to be proven to have become reality only because of the ballpark, and not because of broader economic factors. In other words, if a new project next door were likely to have taken place anyway, the public funding wasn’t necessary.

Third, people would need to spend money in or around the ballpark in addition to their usual leisure spending, and not simply as part of it. Going to a game, economists say, almost always takes place instead of, say, going bowling or spending a night at a brewery. Leisure dollars, therefore, are simply moved around, meaning the money spent at the ballpark would have been spent elsewhere anyway.

“And ballparks create crowds and congestion that requires a net increase in emergency services and transportation infrastructure,” Roger Noll, an economist at Stanford University, said.

Lastly, creating a special tax district can’t come at the expense of other city needs. This, in the eyes of economists, may be the hardest task, if not an impossible one. The city will not be taxing these properties at higher rates but instead take extra tax revenue in the coming decades and devote that toward paying off the stadium bond.

“This is not a victimless increase,” said Daniel Etna, the co-chair of the sports law department at the New York firm Herrick Feinstein. “There are costs to be borne.”

Economists say new tax revenue is needed for city services like police and fire coverage, schools, snow plowing or other needs. By devoting new revenue to the ballpark bond, other city properties will have to make up the difference.

“Part of the economic activity that will occur in the redevelopment zone will substitute for economic activity that now takes place elsewhere in the city,” Noll said. “Thus, tax revenues from outside of the development project will be lower than otherwise would occur in the absence of the development.”

Feasibility becomes harder

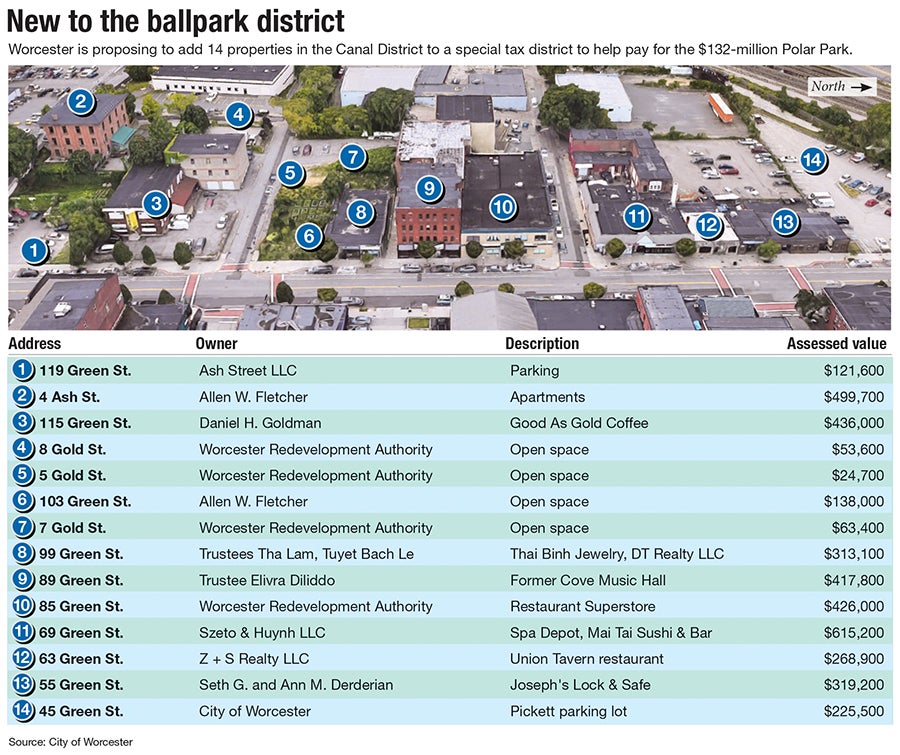

The special tax district was originally to encompass mostly mixed-use buildings expected to rise beyond left field and across Madison Street. Now, the city is looking to add 14 more properties along the west side of Green Street.

Along with an increase in the parking fees for WooSox games, those 14 properties are responsible for making up about $20 million in the public cost overruns for the stadium project. But as they valued at a little over $3 million combined, the 14 sites brought in less than $1 million combined in city taxes in the most recent fiscal year. The parcels will need to create more than that amount in additional revenue every year to pay off the ballpark, putting pressure on new development to take place there.

Revenue from the tax district is not guaranteed and typically unsuccessful, said Nola Agha, an economics professor at the University of San Francisco whose work specializes in minor league baseball.

The city’s revenue streams are largely vague and built on assumptions, Agha said. The team’s revenue, on the other hand, is virtually guaranteed, including through ticket revenue, she said.

Public costs for the project are now so high – the city needs to pay off $137 million over 30 years – virtually everything would need to go as ideally as could be for new revenue even approaching that amount. The team is paying $43.5 million of that money over 20 years, but it will be able to keep most of the ballpark revenue, including the facility’s corporate naming rights from Worcester drink manufacturer Polar Beverages.

Allen Sanderson, an economist at the University of Chicago, described the city’s costs as out of the ordinary for public spending on stadiums.

“I’d regard this one as extreme in terms of the city’s commitment or exposure,” he said. “They should have been able to negotiate a much better split.”

Behind schedule

As for the challenge of related development taking place on time, completion already appears to be behind what was first envisioned.

The first phase of the mixed-use development just outside Polar Park was originally said to open by Jan. 1, 2021 in an agreement reached in 2018 between the city and developer Denis Dowdle.

The first buildings – a residential building south of Madison Street and an office building just beyond the park’s left field wall – now won’t open until September 2021. Other buildings are due to come on line in 2022 and 2023.

To experts, the latest on these projects sound distressingly familiar, especially the overruns.

“That’s pretty much par for the course,” said Victor Matheson, an economics professor at the College of the Holy Cross in Worcester. “We see this all the time.”

“The real issue,” said Joel Maxcy, a sports management professor at Drexel University in Philadelphia, “is why is this cost overrun commonplace in stadium finance and why aren’t lessons from past experiences ever learned?”

Odds are steep Worcester can still find success making ends meet with Polar Park costs, the economists said. And despite the city’s mantra about no existing taxpayer money going toward the project, there’s only one place to turn if revenues fall short.

“The loan must be repaid, and any shortfall will have to be made up from somewhere else,” Maxcy said, “so the city and its taxpayers are on the hook.”

In looking to play catchup on revenue generation, the city has other strikes against it, too, economists say: The ballpark will be closed more than 75% of the year, severely limiting how often hoards of fans will be coming through the neighborhood.

“One ought to view the ballpark as the ‘tail’ and not the ‘dog,’” Sanderson said. “That is, these facilities tend not to be economic catalysts for one simple reason: They’re closed most of the time.”

Still, in the eyes of city officials, the choice was to build the ballpark or see the underutilized old industrial land sit for generations more.

Mayor Joseph Petty compared the Polar Park site to DCU Center and Saint Vincent Hospital, which were built downtown in 1982 and 1999, respectively.

“What else would be there?” Petty said. “Probably nothing.”