Post-Recession, Region’s Banks Gaining Strength

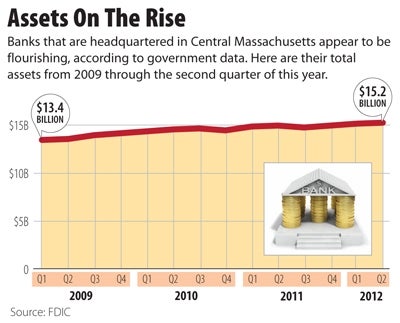

Data from the Federal Deposit Insurance Corp. (FDIC) shows that, as a whole, community banks in the region have weathered stormy economic conditions in recent years and appear to be thriving.

Combined total assets for Central Massachusetts-based banks climbed steadily between 2009 and 2012, from $13.4 billion to $15.2 billion. During the same span, the banks appeared to have a particular edge over statewide averages in core capital ratios — the percentage of a bank's capital to its risk-weighted assets. The average for the region has increased from 9.44 percent to 10.15 percent, while the state average has dropped from 9.81 percent to 8.06 percent. (See related story, Page 14.) And in both the region and the state, past-due assets have dwindled in the aftermath of the Great Recession, while as a whole, total assets have climbed steadily.

In a time when large financial institutions have suffered, banking officials from the five fastest-growing Central Massachusetts community banks say there's been ample opportunity to add customers who would prefer to do business with smaller institutions.

But that doesn't mean growth has come easily. Thanks to record-low interest rates and a housing market that's still weak, banking officials say they're operating under tighter margins than ever. This makes the recipe for success of the five fastest-growing Central Massachusetts banks, in terms of total assets, all the more intriguing. Here's a little insight into each.

UniBank for Savings

Headquarters: Whitinsville

Asset Growth, Q22009-Q2012: 48.9%

What could possibly account for a total asset growth of nearly 50 percent since 2009? According to UniBank CEO James F. Paulhus, it's simple: “tremendous” growth in deposits.

“We have grown deposits in every category by double digits,” Paulhus said.

UniBank handles banking for many municipalities, as well as commercial and personal banking customers. Paulhus said the fallout of the 2008 banking crisis prompted more customers from each category to turn to local institutions, like UniBank.

“When the financial industry got hurt severely in 2008 and 2009 … we believe many municipalities and businesses were concerned about their deposits,” Paulhus said.

Those deposits have, in turn, allowed UniBank to grow the lending side of the business. Paulhus said UniBank has consistently ranked in the top 10 in lending growth rates among all Masssachusetts banks since 2009. He expects that trend to continue.

In light of its success, the bank, which recently opened new branches in Milford and Worcester, plans to open its 10th branch in Grafton in 2013, according to Paulhus, and is on the lookout for more new locations.

Hometown Bank

Headquarters: Oxford

Asset Growth, Q22009-Q2012: 44.6%

As the market becomes saturated with bank locations, and bank officials look to save money, Hometown Bank CEO Matthew S. Sosik said more banks will look to consolidate, as Hometown did in April 2011 when it merged with the former Athol-Clinton Cooperative Bank. This accounts for much of the nearly 45-percent growth Hometown saw between 2009 and 2012, Sosik said, adding about $75 million in assets to make it a $300-million bank.

But Hometown experienced steady asset growth leading up to the merger, which Sosik attributed to the bank's focus on engaging customers in long-standing banking relationships, using checking accounts as the primary point of entry, as well as concentrating on cost efficiency.

Despite Hometown's success, Sosik's attitude about prospects for community banking is tempered.

“2011 was our most profitable year ever,” Sosik said. “With that said, within the context of this brutal housing recession and interest rate environment, there are a lot of stressors in this industry.”

In addition to low interest rates, banks are contending with compliance requirements outlined in the Dodd-Frank Wall Street Reform and Consumer Protection Act, which make it more difficult to stay within margins.

Commerce Bank & Trust Co.

Headquarters: Worcester

Asset Growth, Q22009-Q2012: 30.3%

Commerce, like many community banks, has taken advantage of the disruption in the market caused by big banks' problems, according to President Brian W. Thompson. In the last four years, deposits have grown about 14 percent, while loans have increased 17 percent, he said.

As a regional bank, what happens elsewhere doesn't affect lending, Thompson said. As a result, Commerce has had a “pretty good run” since the recession hit in late 2007.

“We grow faster than the market is growing. At the same time, in our industry and our business, you have to be careful (with lending),” Thompson said.

Lending to existing customers has not increased — the number of new customers added since the recession is where the 30.3-percent growth in total assets stems from, according to Thompson. Making smaller loans to local business has helped Commerce grow, Thompson said. He added that the Central Massachusetts banking industry, in general, has been lucky.

“Although we were hit by the recession, I think there were other areas of the country, and even the state, that were further impacted than us,” Thompson said.

Marlborough Savings Bank

Headquarters: Marlborough

Asset Growth, Q22009-Q2012: 22.2%

At Marlborough Savings Bank, it's the existing customers who are responsible for steady growth in total assets, said Ellen Dorian, senior vice president. Deposits, lending, and personal banking have increased across the board since 2009, according to Dorian.

“It's a little bit of everything,” Dorian said. “What we're seeing is our customers are looking to do more business with us, so it's wallet share.”

Dorian agreed with fellow bankers who said that customers appreciate doing business with local banks. But she said the region's economic diversity has also helped preserve the bank's lending business quite a bit. Marlborough Savings has actually expanded resources in its small-business lending department to accommodate business, Dorian said.

“The economic diversity we have in this region helps quite a bit,” Dorian said.

Rollstone Bank & Trust

Headquarters: Fitchburg

Asset Growth, Q22009-Q2012: 15.2%

With margins at record lows, according to CEO Martin F. Connors, Rollstone has grown against the odds. The bank, which grew more than 15 percent between 2009 and 2012, accomplished that by expanding commercial lending and municipal banking services in a number of communities in Northern Worcester County.

“We work at it every day,” Connors said. “It's not easy. This is a very difficult interest-rate environment for everyone.”

The visible effects of Rollstone's increased assets include expansion projects, including the opening of a professional services office in Worcester in 2011, and construction of a new branch and wealth management office in Leominster, now underway. The bank's four-year-old wealth management program, a major focus, has also grown rapidly to $60 million, according to Connors.

Even though Rollstone is making gains, Connors said the bank must be very scrupulous as interest rates continue to stay low.

“We're being very conscious on the cost side and we're just riding it out,” Connors said.

Read more

Small Business Options For Financial Guidance, Lending

Commerce Bank Completes Acquisition

Berkshire Bank Makes $1.6M Westborough Purchase

Hometown Bank To Open Auburn Branch

Dodd-Frank Bank Reform Also Impacts Investment Managers, Advisers

0 Comments