Report: Majority of Greater Worcester PPP loans went to wealthy, white neighborhoods

Photo | Grant Welker

A quiet Main Street in downtown Worcester

Photo | Grant Welker

A quiet Main Street in downtown Worcester

The vast majority of federal Paycheck Protection Program loans in the Worcester metropolitan area went to upper and middle income white neighborhoods, according to geocoded data released by Washington nonprofit National Community Reinvestment Coalition, which focuses its work on fighting discrimination in lending, housing and business.

The organization compiled local and national data by geocoding the addresses listed on PPP applications, after the U.S. Small Business Administration released detailed data about the $523-billion loan program, which was designed to help small businesses survive an economic crisis brought on by the coronavirus pandemic.

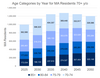

According to NCRC data, a little over 8,000 PPP loans were given to Worcester area businesses in upper and medium income census tracts where less than 30% of residents are people of color. In turn, on the other end of the spectrum, only seven PPP loans were issued in census tracts considered low-income and where more than 80% of residents are people of color.

The NCRC findings jibe with WBJ's own research into PPP lending for businesses own by people of color: of the PPP recipients in Central Massachusetts who identified their race, 84% were white, 8% were Asian, 6% were Hispanic & 2% were Black.

In creating the program, Congress directed the SBA to prioritize businesses owned by people of color, along with those in rural communities.

In the NCRC findings, there was no data indicating any PPP loans were distributed to any upper and medium income census tracts where over 80% of residents are people of color, although 172 were reported for upper income census tracts where between 50% and 80% of residents are people of color, and 748 were reported in moderate and low income neighborhoods with the same density of people of color.

These local figures reflect national data trends, according to the NCRC report.

“This shows us yet again why gathering and releasing lending data is so important, even when it's uncomfortable to lenders or the government,” said NCRC CEO Jesse Van Tol, in a statement. “Small business financing isn't available or distributed equitably, and the findings from this report suggest a bigger problem.”

This data analysis comes after a separate report from Harvard-based research and policy analysis group Opportunity Insights Recovery Tracker, which indicated the number of open small businesses in Massachusetts was down 37% as of Nov. 16, compared with January. Nationally, that figure was 28.9%.

PPP was activated as part of the Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act, a $2.2-trillion economic stimulus bill signed into law by President Donald Trump on March 27.

1 Comments