Southborough’s RxAdvance is a smaller player in an industry dominated by giants like CVS’ Caremark or Express Scripts.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Southborough’s RxAdvance is a smaller player in an industry dominated by giants like CVS’ Caremark or Express Scripts.

It was RxAdvance, however, that landed a giant itself this spring: Amazon.

The behemoth dominating the online retail world chose RxAdvance to be its pharmacy benefits manager for a subset of their employees working in select states.

Where did they switch from? Express Scripts, part of the $150-billion Cigna corporation.

That’s not the only big name RxAdvance has lured. Its major investors include the pharmacy chain Walgreens, which has more than 9,000 stores, and the health plan manager Centene, which has more than 15 million members – triple the number from four years prior – and in 2019 brought in nearly $75 billion in revenue.

Both Walgreens and Centene formed a strategic partnership with RxAdvance last fall for what they called a new model for pharmacy management, one that includes a pharmacy chain, pharmacy benefits manager and an insurer, each of which are otherwise independent.

Ravi Ika, the founder and CEO of RxAdvance, talks confidently and matter-of-factly about how the small player – with 200 employees today – is making waves.

“They’re coming from larger carriers,” Ika said of customers and partners.

How? RxAdvance, which has 2 million pharmacy patients using its management service, has low administrative costs including a largely automated management program, Ika said. A workforce that might be a quarter of the size of another firm with similar membership numbers allows it to have more competitive pricing.

Little known but growing industry

The pharmacy benefits management, or PBM, industry works as a middleman of sorts between patients and providers, including private health plans, Medicaid programs, employer groups and accountable care organizations, known as ACOs.

Benefit managers like RxAdvance can be a largely invisible part of the process of obtaining and managing a prescription, but they’re necessary, said Dennis Lyons, a senior associate who consults on the pharmacy industry for Gates Healthcare Associates of Middleton.

PBMs help handle processing of millions of prescriptions, with infrastructure otherwise built into pharmacies or insurers, Lyons said. They connect large and small pharmacies and insurers otherwise having to forge their own connections to manage prescription drug coverage.

PBMs are important if little known, Lyons said.

“What might be most pronounced is the lack of knowledge most have about it,” he said of the industry.

Once a PBM has developed algorithms or other automated steps, Lyons said, the process is very scalable, with transactions largely handled by technology. In RxAdvance’s case, its web-based platform is accessible by prescribers, members, pharmacists and health plans.

Such firms earn revenue in large part by drug rebates or through fees charged to pharmacies, insurers or drugmakers they work with. Ika said RxAdvance doesn’t take any rebates or conduct spread pricing, a practice in which PBMs charge a payer more than it reimburses a pharmacy and keeps the rest.

PBMs have sometimes come under fire, including in a report last year by the Massachusetts Health Policy Commission, an independent state agency charged with monitoring healthcare spending in the state.

A report highlighted what the commission said were higher prices charged for generic drugs than those drugs cost in Medicaid or commercial insurance plans. The commission, which called out spread pricing, said those prices exceeded $10 per prescription for a quarter of drugs.

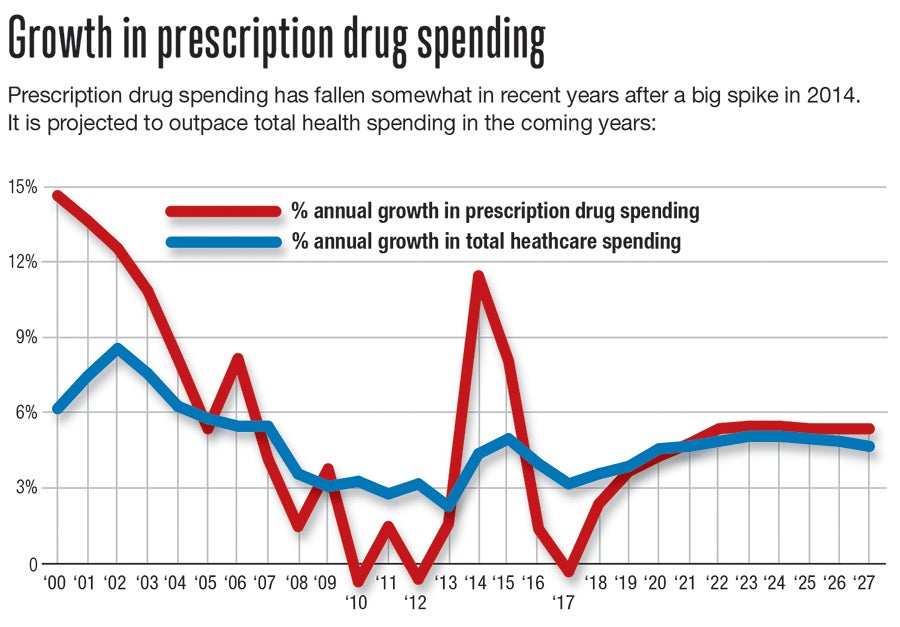

The PBM industry has grown to a $534-billion market employing more than 40,000 workers, according to international research firm IBISWorld. The industry grew 13% in the five years ending in 2019, the firm estimates.

Lyons expects the industry to keep growing, in large part because of an aging population and higher rates of prescription drug use later in life.

“Demographics play an important role,” he said.

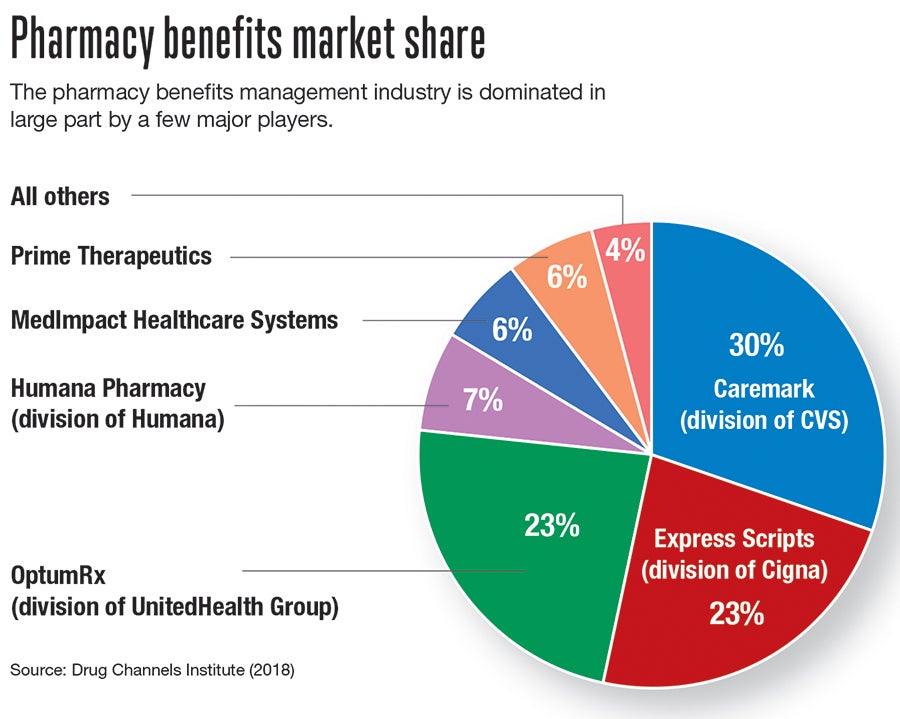

The industry today is dominated by just a few major players.

CVS’ Caremark division is the largest, with 30% market share, according to the pharmaceutical analysis website Drug Channels Institute. Express Scripts and OptumRx add another 23% each. Between those three, three-fourths of the industry is spoken for.

Finding a niche

RxAdvance doesn’t compare in size to those giants but has ambitious plans of its own.

In August, the company is slated to move across town in Southborough to an 80,000-square-foot office at 136 Turnpike Road. That space more than doubles the square footage the company has today, and will accommodate an expected hiring binge to reach 500 workers by next year. The coronavirus pandemic hasn’t stopped those plans.

“We have not stopped hiring,” Ika said.

Among new workers, at least 100 will be in technology and software, and another 100 split among pharmacy technicians, business operations and financial positions.

Ika has successfully built a business before. He ran pharmaceutical payer platform company, ikaSystems, for 12 years before selling it to Blue Cross Blue Shield of Michigan in 2015. He started RxAdvance because he said he saw dissatisfaction among insurance payers using top PBMs.

“They weren’t satisfied, and they didn’t have a choice,” he said of a relative lack of other good options.

RxAdvance has grown significantly already in its seven years, even if it remains a firm with low name recognition. Within its first year, it acquired SentiCare, a prescription monitoring company in Hopkinton, a deal giving it a camera-based device called PillStation giving providers visual confirmation medications are being taken appropriately at a patient’s home.

Now, RxAdvance has 65,000 pharmacies in its network, half of which are independents, according to the company. The firm expects revenue this year to top $2 billion.

Ika doesn’t expect the pandemic or a related downturn in the economy to slow RxAdvance’s momentum or keep it from a fast hiring plan.

The company has a young workforce, with roughly three-fourths who are Millennials or Generation Z. About half of the workers live in or around Boston, and Ika said competitive salaries have drawn workers out of Boston and into MetroWest to work for the company.

RxAdvance’s new offices are slated to include breakfast, lunch and dinner, as well as exercise facilities for the convenience of employees working long hours.

CORRECTION: Some of Amazon's employees, not all, have RxAdvance as their pharmacy benefit manager.