State's annual $61B budget sent to Healey's desk

Image I Chris Lisinski/SHNS

Massachusetts legislature approved the state's budget proposal n the earliest date in nearly a decade in 2025.

Image I Chris Lisinski/SHNS

Massachusetts legislature approved the state's budget proposal n the earliest date in nearly a decade in 2025.

The Legislature on Monday tossed the budget hot potato to Gov. Maura Healey, approving an annual spending bill on the earliest date in nearly a decade as Congress hurtles toward major spending cuts that could force significant revisions to state plans.

A day before the start of fiscal year 2026, the House and Senate accepted a compromise $61 billion annual budget that ramps up spending on health care, education, transportation, and other key areas while reining in rental broker fees, codifying free bus trips at regional transit authorities, and allowing the use of political campaign funds for adult care services.

The House voted 139-6 and the Senate voted 38-2 in favor of the budget. All eight votes against it came from Republicans: Reps. David DeCoste of Norwell, John Gaskey of Carver, Marc Lombardo of Billerica, Alyson Sullivan-Almeida of Abington, Ken Sweezey of Pembroke and Justin Thurber of Somerset, as well as Sens. Kelly Dooner of Taunton and Ryan Fattman of Sutton.

Dozens of other Republicans, including the minority leader in each chamber, supported the budget.

Final action under the Golden Dome occurred at the same time the U.S. Senate was churning through amendments to a massive tax relief and policy bill -- which President Donald Trump dubbed the "big, beautiful bill" -- whose final contours could reshape state spending plans across the country.

"Some have said that this piece of legislation is actually the real big, beautiful bill being taken up this week," House Ways and Means Committee Chair Aaron Michlewitz, a Democrat, told his colleagues while introducing the budget accord. "Unlike the one in Washington, this piece of legislation is one that will not hurt our residents, but will help improve the lives of all our constituents, not just the ones with the largest paychecks."

It's the earliest the Legislature has completed an annual state budget in nine years, tying the June 30 enactment date on the fiscal 2017 budget.

Michlewitz, who alongside Senate counterpart Michael Rodrigues has demonstrated comfort with budget negotiations stretching weeks into the new fiscal year, said the growing specter of federal funding cuts prompted a faster approach this time around.

"With deep uncertainty on the horizon, both from an economic standpoint and from any actions Washington might take in the near future, we felt it was in the commonwealth's best interest to finish this budget in a quicker manner than has been the case in the past few years," Michlewitz said.

Across the hall, while senators took up the budget, Rodrigues said Massachusetts is already feeling fiscal effects from the Trump administration before final action on the megabill. Tariff impacts on businesses and consumer spending have already resulted in "less-than-anticipated state tax revenue," Rodrigues said, while cuts to scientific research funding and "the elimination of these thousands of jobs have caused a decrease in state income tax collections."

Healey gets 10 days to review any bill sent her way, and barring a superhuman speed-review of the 416-page package, Massachusetts will again fail to have an annual budget in effect by the July 1 start of the fiscal year. The last time a governor was able to sign a budget into law before the fiscal year began was in 2010.

Lawmakers on Monday also sent Healey an interim budget to keep payroll and government services flowing in the early days of fiscal 2026 while the governor reviews the annual plan. Healey signed that stopgap measure Monday afternoon.

The almost $7.5 billion in spending authorized by the interim budget does not get lumped on top of the $61 billion approved in the annual budget. The interim budget includes language specifying that it "shall cease to be operative on the effective date of the general appropriation act" and also provisos that "all actions taken under this section shall apply against that general appropriation act" and that "all expenditures made under this section shall be consistent with appropriations made in the general appropriation act."

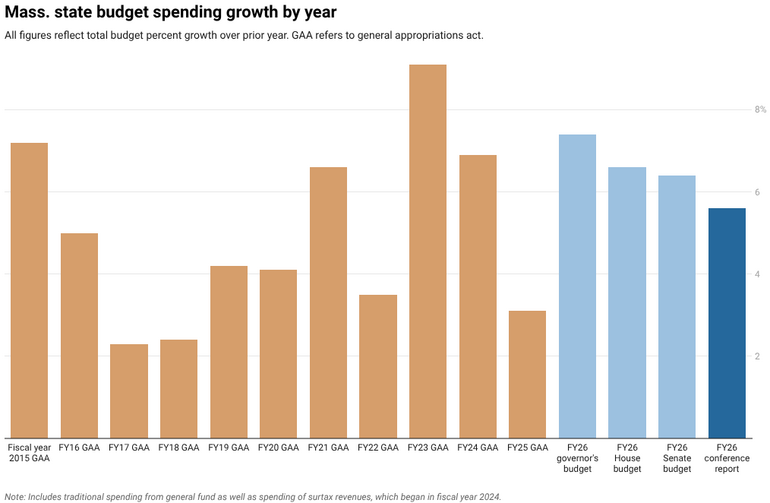

The compromise annual budget would increase state spending about $3.3 billion, or 5.6% over the spending plan Healey signed last summer. Health care, including MassHealth, and education remain some of the largest cost drivers.

In addition to revising some key line items, legislative negotiators reshaped some of the math undergirding their budget.

The accord has a bottom line just north of $61 billion, nearly half a billion dollars less than the House- and Senate-approved versions and about $1 billion below the proposal Healey offered in January.

A chunk of that reduction came from MassHealth, which combines the state's Medicaid and Children's Health Insurance Program under one umbrella. MassHealth remains the single largest area of spending in the budget, but the $22.1 billion the conference committee proposed is roughly $300 million less than either branch originally proposed, according to an analysis the Massachusetts Taxpayers Foundation published Monday.

The think tank said it's "unclear if any specific programmatic changes are assumed in this lower spending figure."

Republicans in Washington, D.C. have spent months pursuing significant Medicaid cuts, which they could achieve through the bill moving in the U.S. Senate. That would trigger difficult budget decisions in the states, which rely on the federal government to cover large shares of Medicaid program spending.

"Any slight impact or slight reduction in federal support for Medicaid could have a material impact on the budget, and those are the facts that we will have to come to face if that action comes to fruition down in D.C.," Rodrigues said Monday.

Another area where legislative negotiators settled on a significant, but lower than first draft, spending total is the MBTA. The $470 million in the conference report for the Boston-area transit agency is $216 million less than Healey and the House proposed and $30 million less than the Senate proposed, according to MTF.

That funding would build on $535 million in one-time, surtax-funded MBTA aid lawmakers and Healey agreed to earlier this month as the agency works to maintain recent service improvements.

Kate Dineen, president of the business-backed group A Better City, and Tom Ryan, the group's senior advisor on policy, government and community affairs, said the deal "presents mixed signals for transportation and jeopardizes the progress made at the MBTA over the past 18 months."

"While we appreciate that the Legislature endorsed a version of Governor Healey's proposal to direct Fair Share surtax revenue toward statewide transportation infrastructure, the final amount falls short of what both the Governor and the Transportation Funding Task Force recommended," Dineen and Ryan said in a joint statement.

The duo said they find the final budget's division of surtax funding "more concerning": About 70% of the pot would go toward education and 30% would go toward transportation, a shift from the roughly 58% education, 42% transportation split in the fiscal 2025 budget Healey signed last summer.

Asked why the conference committee settled on significantly more surtax revenue for education than transportation, Senate President Karen Spilka attributed the decision to "the art of negotiation."

"There's no science, necessarily, but just the give and take of negotiations," she said.

Despite scaling back proposed MBTA investments, lawmakers overall decided to draw down even more money from the surtax than they first proposed.

Beacon Hill's budget-writers together estimated the state would collect at least $2.4 billion from the surtax in fiscal 2026, but agreed to spend no more than $1.95 billion of that through the annual budget.

But the conference committee decided to scrap that more conservative cap and instead created a plan that would use the full $2.4 billion estimate.

That move effectively allowed lawmakers to press for more spending despite the big-picture fiscal uncertainty by shifting hundreds of millions of dollars from non-surtax revenues, whose growth appears constrained, to the voter-approved levy, which has continued to perform well.

Early education, K-12 education, higher education and the state's 15 regional transit authorities are all in line for more surtax funding under the compromise budget than they would have received from either the House or Senate versions, according to MTF.

MTF last week cautioned that non-surtax revenue collections in Massachusetts could fall $600 million to $1 billion below original fiscal 2026 forecasts due to federal trade and tariff possibilities and the potential for a recession.

Lawmakers opted not to change the revenue estimates in the fiscal 2026 budget deal.

House Minority Leader Brad Jones told the News Service the majority of the GOP caucus is "pleased" the final budget does not incorporate any of the tax increases or expansions Healey proposed, such as applying the sales tax to candy.

"I think generally the caucus is very pleased with the approach on local aid, the per pupil increase, fully funding the Student Opportunity Act, incorporating some of the increase that the Senate included in [unrestricted general government aid] that the House had not," Jones said ahead of the budget vote. "So I think on that basis, I think people are pleased with the fact that the bottom line is a little bit lower. And obviously, I think everybody shares the apprehension of what are the things that are potentially going to happen or are going to happen in D.C, and how they are going to impact us?"

Jones added the compromise budget does not typically feature a bottom line that is lower than what the governor proposed.

"There's certainly reasons for there to be kind of a blinking yellow light because there's uncertainty about federal policy and what it means," Jones said.

Negotiators backed away from many of the policy riders the House and Senate each sought to attach, and the final version does not include provisions designed to lower prescription drug costs, give municipalities more authority over alcohol licenses, or pause changes to vocational school admissions policies.

They also scrapped a House-approved measure granting $14,000-per-year raises for the eight members of the Governor's Council.

Leaders of the conference committee negotiating the budget announced Friday they had reached a deal, and lawmakers filed the accord Sunday afternoon.

0 Comments