WBJOURNAL.COM EXCLUSIVE: Bose No Longer Worth A Billion | Only one from Central Mass. left on Forbes list

Pity Amar Bose. The founder and namesake of the famed Framingham speaker company has dropped off Forbes Magazine's list of the world's billionaires.

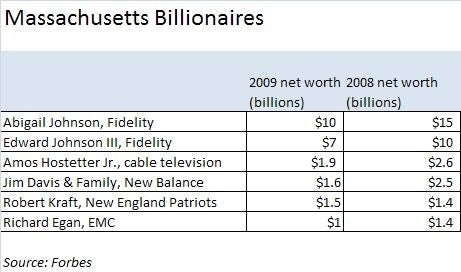

Bose's departure leaves Richard Egan, cofounder of another MetroWest giant, EMC Corp., as Central Massachusetts' only representative on the exclusive list. And, according to Forbes, Egan's net worth has declined over the past six months. In its September 2008 list of the 400 richest Americans, the magazine put his wealth at $1.4 billion. The March list of billionaires said Egan, who retired as EMC's chairman in 2001, was worth an even $1 billion.

Bose faced a similar fate in the recent economic downturn. In the September 2007 list of the richest Americans, Forbes put his net worth at $1.8 billion. By the same time in 2008, that was down to $1.5 billion. Now the wealth held by the former MIT assistant professor has apparently fallen below $1 billion. According to Forbes, he is believed to own a 60 percent stake in Bose Corp., which, like many companies, has been going through difficult times in recent months. In January, the company announced that it would cut 10 percent of its workforce, or about 1,000 jobs.

Bad Times For Billionaires

Bose and Egan are not alone. Forbes reports that the average worth of the world's billionaires has dropped 23 percent over the past year. The total number of billionaires dropped from 1,125 to 793.

That's no surprise to Eric Hamilton, of Hamilton Wealth Advisors in Westborough. He said both rich and more modest investors generally find themselves unable to make their wealth grow in the current environment.

"The biggest conversation over the past several months has not been ‘what can I make on my money' but ‘how can I protect it,'" he said.

Hamilton said even avenues like hedge funds and commodities markets aren't doing well, and conservative investments like treasury bills are yielding 1 percent or less after inflation.

"There is no really good answer," he said.

Hamilton said he advises his clients these days to take a more active role in their investments. He said many investors have become more risk-averse as the economy has tanked, leaving room for the adventurous to find potential bargains.

"It kind of depends on what's your risk appetite," he said.

As for the other five Massachusetts billionaires on the Forbes list, all but one has taken a hit in recent months. Abigail Johnson and Edward Johnson III of Fidelity Investments top the state's list with $10 billion and $7 billion, respectively, but both are down from the previous year. Cable entrepreneur Amos Hostetter Jr. and Jim Davis of the New Balance shoe companies saw their net worth fall too.

The only Massachusetts billionaire to see an increase in wealth was Robert Kraft of the New England Patriots, perhaps proving that football is a recession-proof industry.

0 Comments