Five years after the 2007 financial crisis and ensuing recession, banks and credit unions in Central Massachusetts are operating in a low-interest environment that forces them to turn increasingly to other revenue sources to stay healthy.

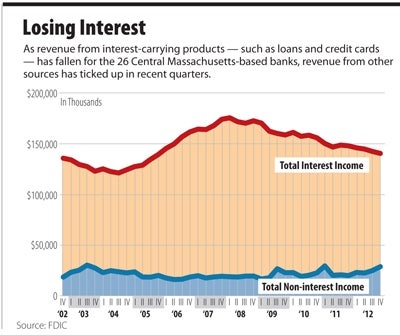

Interest income — revenue from interest-generating offerings like credit cards and loans — has declined steadily since 2009 because of historically low interest rates. The Federal Reserve has kept interest rates low in an effort to boost lending and spur consumer spending.

But that fiscal policy has taken its toll on banks and credit unions.

Through the third quarter of 2012, the region’s five largest credit unions saw their interest income fall 18 percent compared to the same period in 2008, according to the most recently available data from the National Credit Union Administration.

Similar Declines Across Board

The decline in interest income has been nearly identical for the 28 banks headquartered in the region, according to an analysis of quarterly data from the Federal Deposit Insurance Corp. (FDIC).

“The combination of a soft economy and low interest rates has absolutely decreased interest income,” said Richard Leahy, CEO of Webster Five Cents Savings Bank. “What you have to do is try to find other ways to make some money.”

But doing that is tricky. Customer fees are important to many institutions’ bottom lines, but checking account customers are sensitive to new or higher fees that impact them directly.

So instead, banks and credit unions look to raise revenue through other means, like selling loans on the secondary market or servicing loans for other institutions.

Bring In Income, Manage Risk

For Webster Five, selling loans has been a vital way to generate fee income and keep long-term, low-yield loans off its books until yields eventually improve.

“Because then you’re stuck with them, and then what?” Leahy said. “The bank’s underwater and you’re not making money.”

Peter Alden, CEO of Bay State Savings Bank, said selling loans on the secondary market has become important for his Worcester-based institution.

“That’s made up a big difference in the past year,” Alden said. “Honestly, you try to find, at all levels, the opportunity to gain other sources of revenue. You look at your expense lines and everything you’re doing, and you try to just be very careful.”

Credit Unions’ Similar Strategy

Selling mortgages and commercial loans to larger financial institutions has become more important for credit unions too, said Joseph Barbato, CEO of Millbury Federal Credit Union.

Wary of scaring off customers with new fees, Millbury formed several corporate subsidiaries known as credit union service organizations, or CUSOs.

Millbury has a CUSO dedicated to making loans and selling them to other institutions. Another offers commercial services.

The revenue has been important. Barbato said his credit union used to be able to cover its operating overhead with net interest income alone. These days, that income covers only 70 percent of the overhead.

Perhaps no credit union in the area has more CUSOs than Webster First Federal Credit Union.

CEO Michael Lussier said Webster First’s CUSOs include an insurance agency, a title company, a real estate holding company and a mortgage servicing company.

“We’ve been able to build up $1 million-plus in reserves due to the additional services we’ve put out for the benefit of our members,” Lussier said. “We’re all worried about this low-interest margin being around for too long. Even for us — we’re well capitalized — and still with inflation we have rising costs and not necessarily rising income.”

Area Sector Keeps Strength

Despite historically low interest rates, banks and credit unions in the region have managed to operate in the black.

Net income for banks in Central Massachusetts has climbed since dipping into the negative in the second half of 2008. It dipped slightly during the first three quarters of 2012 compared to the same period in 2011, but was up over that same span in 2010.

For the five largest credit unions, net income was up 34 percent for the first three quarters of 2012 compared to 2011, driven largely by an increase for Digital Federal Credit Union.

Increases in both profits and noninterest income fit a national trend.

Banks across the country saw a 6.6 percent increase in net income in the third quarter, driven largely by a 7-percent rise in noninterest income and declines in the amount of money banks had to set aside in case of loan losses, according to the FDIC.

And a report from Washington, D.C.-based credit union consultancy Callahan & Associates found that, as of the third quarter of 2012, credit unions nationwide had generated the highest amount of noninterest income since the same period in 2009, up 18 percent over the first nine months of 2011.

Callahan credited high mortgage refinancing activity as well as income from CUSOs and debit card interchange fees.