When Central Massachusetts businesses turned to banks for help applying for federal loans for coronavirus pandemic relief, they often skipped over local lenders in favor of national and larger options based outside the region, according to a Worcester Business Journal review of program data.

Those larger banks were chosen most often for the program’s biggest loans. Central Massachusetts businesses received 124 loans of $2 million or more from the Paycheck Protection Program to help keep them afloat and their workers on the job. Of those, 32 were processed through Central Massachusetts-based banks or credit unions.

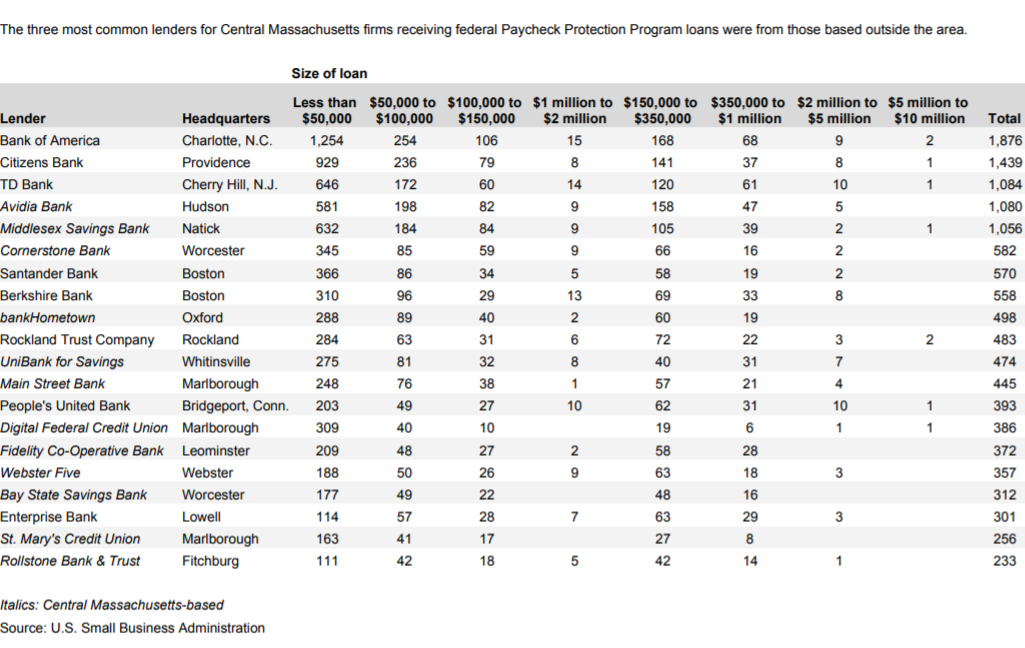

Area companies were most likely to turn to some of the biggest names in banking: Bank of America, Citizens Bank and TD Bank. Those three landed first, second and third in local PPP lending, according to U.S. Small Business Administration data.

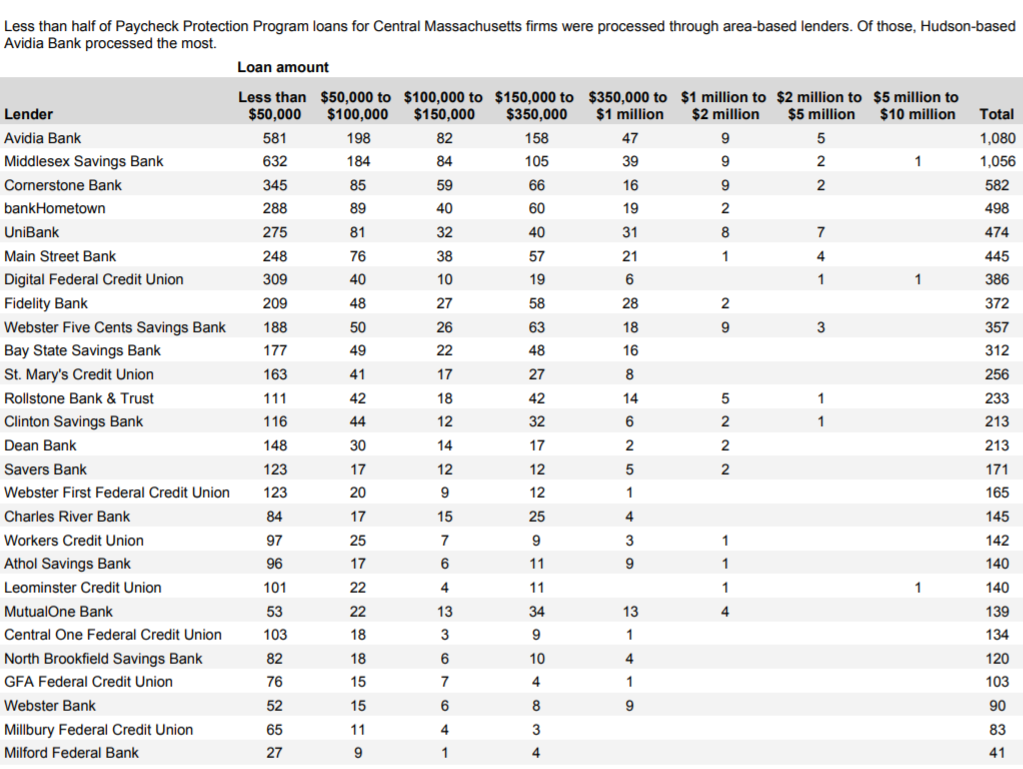

Roughly 18,000 loans were made to Central Massachusetts businesses as part of the federal aid program. Of those, about 8,000, or almost 45%, passed through local banks or credit unions.

Central Massachusetts firms turned to roughly 300 different lenders for PPP loans, federal data shows, which may be a factor of where a local office’s parent company does its accounting business. About one out of 10 lenders was based locally.

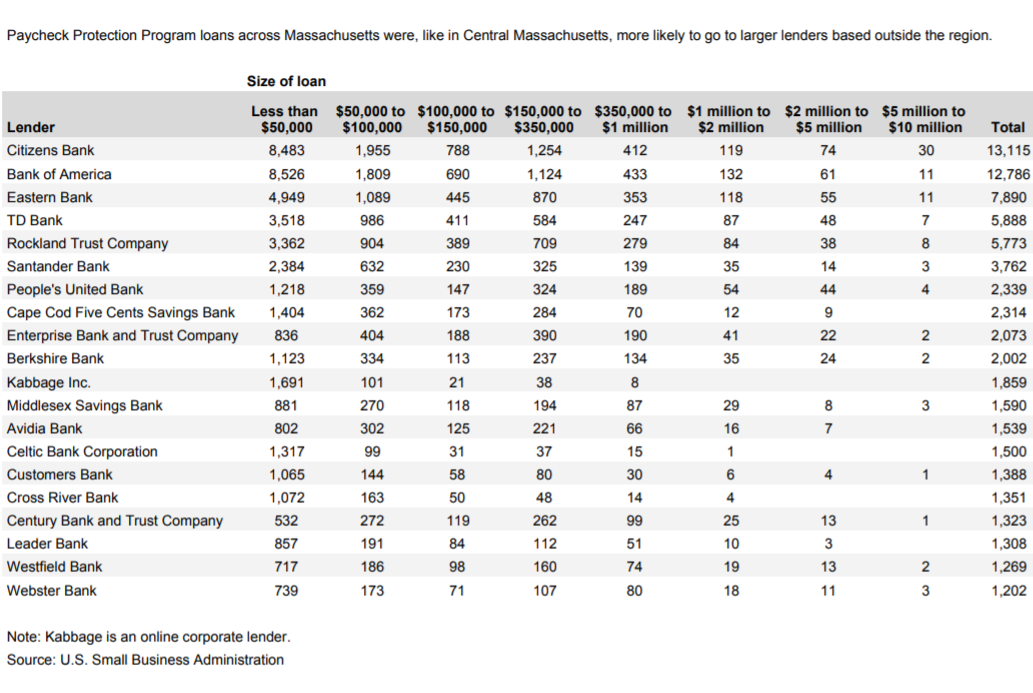

Among all PPP lending statewide, Natick-based Middlesex Savings Bank — the largest Central Massachusetts-based bank by deposits — ranked 12th in number of loans. Hudson-based Avidia Bank was 13th. In all, Massachusetts companies identified using roughly 700 lenders for the program.

Many of the most-used banks and credit unions in Central Massachusetts were already dedicated SBA lenders, including each of the top five: Avidia, Middlesex Savings Bank, Worcester-based Cornerstone Bank, Oxford-based bankHometown and Whitinsville-based UniBank.

Avidia — the result of the 2007 merger of Westborough Bank and Hudson Savings Bank — began preparing for an onslaught of PPP loans as soon as the program was approved as part of the federal CARES Act, said Rita Janeiro, a senior vice president for community banking at Avidia.

“From the time we started to hear about the stimulus initiatives, we of course began preparing for it,” Janeiro said. “It was a rush to get everything in place with last-minute guidance. It was kind of a blur.”

In all, Avidia processed loans totaling $190 million, mainly for existing clients, she said. Without being able to visit a physical branch, clients reached out by phone, email, even LinkedIn and Facebook, to get in touch with Avidia representatives to figure out how to apply.

“It was just an assembly line of phone calls and emails,” Janeiro said. Local banks who know their clients are a good place to turn for PPP assistance, she said.

“As far as expertise, no doubt about it,” she said. “We’re on par with any of those bigger competitors.”

Daniel Forte, the president and CEO of the Massachusetts Bankers Association, agreed, saying smaller banks made a disproportionately large share of overall loans compared to far larger competitors.

“For the number of loans, the smaller banks did the better job of getting the money out the door,” Forte said. Despite some PPP glitches early on, he said, “this program was phenomenally successful” in how many jobs it retained.

The onslaught of work for weeks during the spring once the loan program started left some banks working around the clock, Forte said. In all, Massachusetts banks made about $14 billion in loans, which averaged about $129,000 per loan, slightly above the national average. The workload was so heavy that banks did 19 years’ worth of volume in about 18 business days, he said.

“We had banks working Easter Sunday. I had banks who had officers working in shifts” around the clock,” Forte said. “And this was during the governor’s work-at-home order.”

A tendency to use some of the largest banks wasn’t unique to the state or Central Massachusetts.

Nationwide, JPMorgan Chase and Bank of America were by far the largest two lenders, according to the research by Edwin Hu at New York University and Colleen Honigsberg at Stanford University. Others included Wells Fargo, Truist, PNC, TD Bank and US Bank. JPMorgan Chase — which ranked 80th in Massachusetts for PPP lending, with just 251 loans — and Bank of America are each in line for roughly $800 million to well over $1 billion each in fees for making PPP loans, according to the research, which was reported by The Wall Street Journal.

More than 4,000 lenders are due to share an estimated $14.3 billion and $24.6 billion in processing fees, the research said.