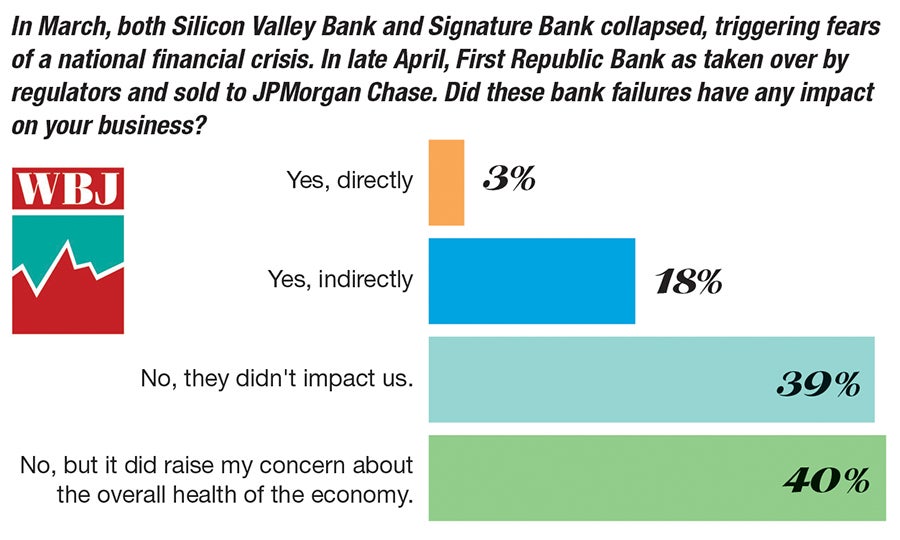

After the first half of 2023 rocked the banking world and as uncertainty clouds the economic future, Central Mass. bankers are staying the course.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Watching, waiting, reassuring, carrying on.

That’s what bankers across Central Massachusetts are doing in what is a volatile economic period after headline-earning bank failures started the year.

Banking executives are staying the course as best they can, while the Federal Reserve Board dictates much of what the next year will look like in the industry. The June 14 announcement of a pause of interest rate hikes from the Fed came with a caveat more were likely to come as the year progresses. How loans, lending, and deposits at Central Massachusetts banks will be impacted is still to be seen.

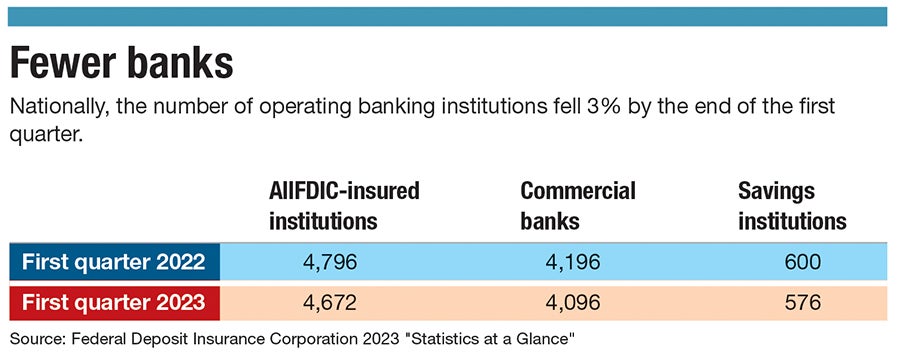

The tumultuous start of the year in the banking industry nationally, with bank runs and failures, has shaken up the deposits local banks are seeing, despite the security offered at Massachusetts banks, which are both insured by the Federal Deposit Insurance Corp. and protected by the Depositors Insurance Fund up to a minimum of $250,000.

Community banks, though not immune to macroeconomic trends, did not experience the same level of issues as the likes of now failed and shuttered larger financial institutions like Silicon Valley Bank and First Republic Bank, and have remained strong, said Jenna Burke, executive vice president and general counsel for government relations & public policy at Independent Community Bankers of America, a national trade group for small U.S. banks in Washington D.C.

“Community banks have demonstrated incredible resiliency,” said Burke.

Further, the widespread financial crisis those bank failures seemed to threaten did not pan out in an alarmist fashion.

“It wasn't a systematic event that happened,” said Martin Connors, president and CEO of Rollstone Bank & Trust, a mutual savings bank, based in Fitchburg.

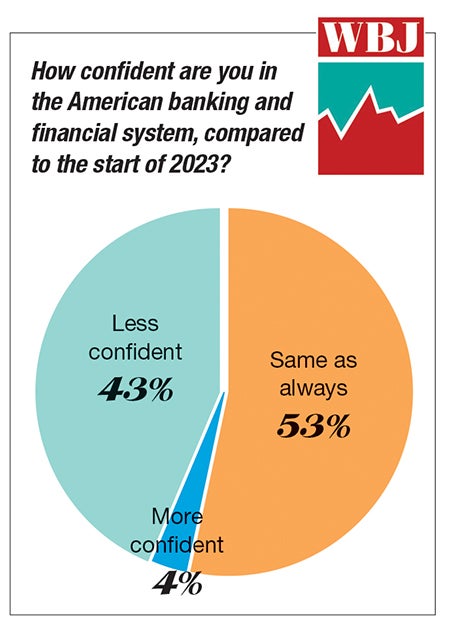

Despite that, conversations about banking and security of deposits became clouded.

“There was so much noise in the banking space,” said Randal Webber, president of Cornerstone Bank, a Worcester community bank.

To combat the negative buzz, a top concern for local banking executives across the board was ensuring their customers knew their money was safe.

“The community bank industry and the value it brings has never been higher,” said Ed Manzi, chairman and CEO of Fidelity Bank, a community bank in Leominster, citing easy communication and trust.

Post-COVID deposits dwindle

Concerns locally at community banks, mutual banks, and regional banks have to do with deposits, delinquencies, and an uncertain future out of bankers’ control, dependent on larger government decisions.

“This all began a few years ago with the pandemic, stimulus programs, and increased deposits," said Robert Morton, president and CEO of state savings bank bankHometown in Oxford.

That stimulus spending kept deposits high throughout the COVID pandemic, but the money the payments injected into the economy has been spent out. Now, those pandemic-era heightened deposit rates are down, and amid a national economic downturn, new deposits are hard to come by at banks statewide.

“Banks are competing for deposits,” said Kathleen Murphy, president and CEO of the Massachusetts Bankers Association, based in Boston. The average size depositor in Massachusetts banks has $45,000, according to data from the MBA.

Nationwide, deposits were at $17.2 trillion the week ending May 31, 2023, after a steady decline from a high of over $18 trillion in the same period of 2022, according to data from the Board of Governors of the Federal Reserve System.

Still, at Webster Five, an Auburn-based community bank, businesses from as far as Idaho have moved their deposits to gain extra security.

“We have brought in a couple of deposit accounts from banks that didn't have 100% insurance,” Webster Five President and CEO Donald Doyle said.

While the bank is attracting depositors from out of state, in-state banking customers have not been shopping rates and moving deposits around, said Doyle, and deposit rates have been low.

Lending in an uncertain future

Low deposits mean that loan activity is impacted, too. It has become more expensive to lend money, said Cornerstone’s Webber, and as such, some banks are responding by limiting loan activity.

“Some banks have been pulling out of lending because of liquidity issues,” said Michael Crawford, senior vice president, commercial regional executive in Worcester for Rockland Trust, a community bank headquartered in Hanover. Behavior spanning the past several years has dictated how banks are able to act now.

“Our lending window is wide open. We are conservative by nature. That culture has kept us protected,” said Crawford.

Independent from a bank's ability or willingness to issue new loans is the issue of demand for loans, which is slowing down, said Doyle, citing factors in the housing market. Demand for mortgages has declined.

The same rings true at Rollstone Bank & Trust, said Connors.

“People aren't making slightly lateral moves,” said Connors. Individuals and families who own homes are staying put.

Marlborough-based Main Street Bank, a mutual bank which operates in Massachusetts and New Hampshire, is approaching the precarious moment by leaning in. Taking advantage of a possibly over-cautious approach elsewhere, the Main Street team is focusing on lending activity.

“When other banks are clamping down and don't have the same lending appetites, there are opportunities for us to pick up new loans at higher rates,” said Walter Dwyer, CEO of Main Street Bank.

The reason for caution is a concern in anticipation of a potential recession, which could result in higher rates of delinquencies with job loss and other economic strains.

“We are at a point right now where the next three to six months are going to be very telling,” said Peter Alden, president and CEO of Bay State Savings Bank, a community bank in Worcester.

On the loan side, Alden anticipates delinquencies could rise if the latter half of this year does bring recession.

Alden is not the only bank executive paying mind to delinquency concerns.

“I don’t wish for this for sure, but I think there will be some challenges to borrowers on the commercial side,” said Cornerstone’s Webber.

Should occurrences of loan delinquency start to rise, however, said Webber, it may be to a more normalized level.

“We’ve had historically low delinquency rates. Almost nonexistent. Even if there is a huge increase, it might just be back to normal” said Webber.

The U.S. delinquency rate on mortgages for one-to-four unit homes was 3.96% in the final quarter of 2022, according to the Mortgage Bankers Association. This was a tick up from 3.45% in the third quarter of 2022, the lowest the rate had been since the association began tracking data in 1979.

Staying the course

Even with delinquency as a concern on the fringe, overall anxiety across the industry is not more than a prickle.

“This year has shown uncertainty that all banks are dealing with, but they remain stable overall,” said ICBA’s Burke.

Weathering what comes next economically is less a matter of predicting recession, but more about a track record of strong financials and overall strength.

“We didn't predict this, but we are being rewarded for being disciplined and adhering to strong asset liability management fundamentals,” said bankHometown’s Morton.

The sense broadly is the best course of action is to stay the course while monitoring whichever way the headwinds may come from.

“Consumers and businesses are still borrowing, and banks are still there, still lending,” said MBA’s Murphy.

At the same time, the banking industry is not immune to the issues plaguing companies across the board. Workforce concerns continue to be a top priority at the MBA, as attracting new workers to the industry and retaining good talent is a challenge.

The aging workforce is an issue, too. “It will create challenges and gaps for smaller institutions,” said Webber. “It’s hard to come by young talent.”

What comes next will largely depend on the actions of the Fed.

“What we can control, we aren’t nervous about,” said Connors. “Our biggest concerns are things out of our control.”

The threat of a recession looms. Doyle is hopeful it will present as more a soft landing than hard recession, he said.

At Fidelity, a look to the past instills confidence in an ability to weather the challenges that come. “We’re a 135-year-old community bank started in Central Mass.,” Manzi said. “We have been through lots of different cycles: depressions, wars, pandemics.”