CPA shortage: The workforce crisis in accounting poses challenges in Central Mass.

Image I Adobestock

While the number of CPAs in the U.S. has increased since 2019, the talent shortage is far from over.

Image I Adobestock

While the number of CPAs in the U.S. has increased since 2019, the talent shortage is far from over.

Back in 2022, the U.S. Bureau of Labor Statistics reported the next decade will see 136,400 openings for accountants and auditors nationally each year, as the accounting profession faced a workforce crisis compounded by retirements, specialization, and historic low enrollments at colleges and universities.

The past few years have seen some improvements, but local experts warn not to be so hasty in declaring the crisis over, especially in Central Massachusetts, which faces several challenges when it comes to drawing in young accountants.

“Communities outside of Boston tend to have a harder time accessing talent … but I think the talent shortage is felt everywhere,” said Zach Donah, president of the Massachusetts Society of CPAs. “Starting salaries in the accounting profession never really kept pace with the starting salaries in other fields, so when you factor in cost of living in a state like Massachusetts, it really adds up.”

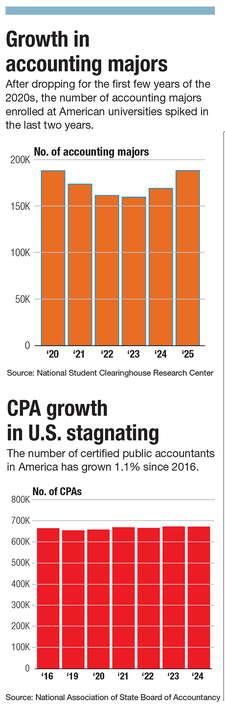

The number of CPAs in the U.S. has increased by 2.67% since 2019, when it reached historic lows, according to data from the National Association of State Boards of Accountancy. Meanwhile, the number of enrolled accounting majors in U.S. colleges and universities has increased by a staggering 17.89% since it reached similar lows in 2023, according to the National Student Clearinghouse Research Center.

Additionally, while the number of CPAs and accounting majors may be increasing, the number of individuals working in tax accountancy, business accounting, or bookkeeping is not necessarily keeping pace.

“The draw of fields like finance or consulting, which pull from similar talent pools but don’t require anything more than a bachelor’s degree, is often understated,” said Karen Teitel, a professor of economics and accounting at the College of the Holy Cross in Worcester. “On top of that, work-life balance is a big thing for the younger generations, and accounting doesn’t necessarily provide that.”

Clashing cultures

“When I started out, it was considered a badge of honor to have worked 90 hours in a week,” Donah said, “but that’s not as popular among the newer generation.”

Furthermore, a greater proportion of certified CPAs are going into more specialized subsets of accountancy, such as forensic accounting, or even into adjacent fields, such as data science and research, said

, a forensic accounting and business consulting firm in Shrewsbury.

“We have a waiting list … I’m asked almost every day if someone can come and work here,” said McLaren.

While data on the proportion of accounting majors working in specialty or adjacent fields is hard to find, the data that does exist at least superficially supports McLaren’s statements. The number of accounting majors decreased substantially from 2020 to 2023, only to shoot back up in 2024. The number of CPAs nationwide remained mostly stable over that time, suggesting that a large proportion of accounting majors don’t go on to become CPAs, and people receiving the CPA licensure are doing so for fields other than traditional accounting.

Fixing the problem

To address the ongoing talent shortage, the American Association of CPAs created the National Pipeline Advisory Group in July 2023. NPAG released a data-driven report identifying six key methods through which the accounting field can attract new talent, including addressing the time and cost of education, growing support for CPA exam candidates, and enhancing the employee experience, including business cultures.

NPAG has seen some success in implementing these methods. While the CPA exam was changed in 2024 to be more personalized, including a section which examinees can choose based on their skills and interests rather than requiring all examinees to take the same exam, educational requirements have been slower to change, as those are set by the state.

Massachusetts is yet to change its educational requirements for becoming a CPA, which consist of 150 credit hours of college coursework, including 30 credit hours of accountancy coursework and 24 credit hours in related fields such as mathematics, statistics, economics, or business administration, according to the Massachusetts Society of CPAs.

Proposed legislation before the Massachusetts House of Representatives aims to allow students with a standard 120 credit hour bachelor’s degree to substitute two years of work experience for the additional credit requirement, but it is yet to pass committee toward becoming law.

As for enhancing the employee experience and business cultures, that’s something that must be handled on a firm-by-firm basis, which firms are handling with varying degrees of success.

“I know for Gen Z-ers, a big thing is that they want to have a community … They want to have a purpose,” said McLaren. “We are seeing some firms listen, and some firms make the necessary changes, and some firms stick to the same-old, same-old.”

While it’s not necessarily a method outlined by the NPAG report, technology, including AI, is being used to attempt to address the talent shortage, both locally and nationally, said Donah. While AI does mean the talent ceiling of entry-level accountants necessarily has to be higher, the detail-oriented nature of accounting work means that accountants, including entry-level accountants, are still necessary to check the computer or AI’s work. However, the automated nature of the technology’s work allows them to handle more accounts more quickly than an entry-level accountant previously could alone.

“Things will have to change in the future to accommodate AI, due to how much it can streamline the work that used to be done by entry-level accountants,” said Donah.

0 Comments