Q&A: Fidelity Bank executive focused on building client-focused relationships

Photo | Courtesy of Fidelity Bank

Joann Marsili, executive vice president, chief growth and client experience officer at Fidelity Bank

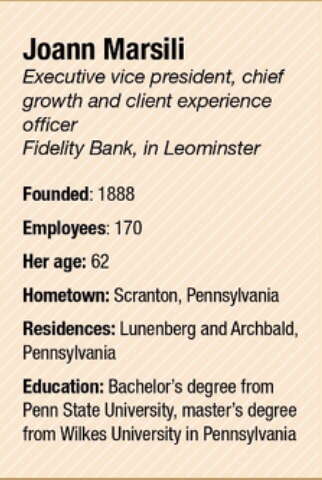

Photo | Courtesy of Fidelity Bank

Joann Marsili, executive vice president, chief growth and client experience officer at Fidelity Bank

Three years ago, Joann Marsili stepped into her role at Fidelity Bank. Since then, she has led a marketing strategy designed to connect and support the 67,000 small businesses across Central Massachusetts. Marsili says she is fostering partnerships, promoting financial wellness, and prioritizing client feedback to enhance the experience and accessibility of every client.

What are your clients looking for?

We have something called LifeDesign, which is what we use to connect with the client. We analyze their needs, recommend products, and then we execute. All of that is framed in a way where we are having meaningful conversations with the client.

A lot of times, a client comes in and doesn’t necessarily have the words for what they need. They just have the problems they're trying to solve, and it's important for us to understand what the problems are and how we connect them back to an easy, intuitive way to use the bank. We're working on getting our business products online so business checking, business savings, and business CDs can be easily opened as if they were in a bank center.

We don't want busy business owners to feel like they must commit to a banking center. Our bankers should be able to go to them and open the accounts in the office with the business owner. Service does not have to be tied to a building. We need to offer the best possible service with the least amount of roadblocks.

How has Fidelity’s approach to banking changed?

Banking has changed greatly in the last 10 to 15 years with all the new digital tools, yet it has stayed the same since it is still rooted in relationships. So, it is important we maintain a relationship, especially with our smaller businesses.

Big businesses have CFOs and accounting teams, but in smaller businesses, the owner is generally the operator and the accountant. They're doing everything, and that's really the space we like to play in. We make sure they have all the digital tools so they can access the bank 24/7. That's probably the biggest change; people do not work on a 9-to-5 schedule anymore, and bankers need to be available whenever a client needs us.

How does Fidelity’s merger with Cape Cod 5’s holding company impact this?

It's a merger at the holding company level, and that means both banks and any others joining us will maintain their own charter. It provides all the services both banks need to run a bank like IT, human resources, and all those administrative aspects. Deposit operations are centralized, so that team is supporting the two banks and any additional bank that might join. It allows the sales, marketing, and community part of the bank to have a hyper local focus.

How do you innovate?

A lot of times people think technology is the answer, but technology is the conduit to the answer. You can have the greatest technology in the world, but if it doesn't work, or it's not easy to use, it's worthless.

When you think about digital banking, you have to think about the client's journey through this banking process. Some studies say people are more apt to use digital tools if they know they can get the help they need if they get stuck.

That's why we built the client care center in Leominster. They are the human voice of digital, so if anybody does have any issues, they can quickly get a banker on the phone.

How is Fidelity growing?

This opportunity to merge at the holding company level has left us with a lot of opportunities in the market, because it’s less expensive to run the two banks than it was to run each bank independently. That gives us more capital to work with. Our banking center managers are now hired with both consumer and business experience, so they can dig deeper into the needs of the marketplace.

All small business owners are also consumer clients, and it is helpful when the banker can talk intelligently and be a trusted financial advisor for both the business and for the business owners’ personal affairs. We have developed a geographic sales team working to align our products and services. The realignment of the sales team and our state-of-the-art products allow us to have deeper conversations.

There are going to be more opportunities for us to find different communities we can serve, and we're always looking at those opportunities.

This interview was conducted and edited for length and clarity by WBJ Correspondent Sloane M. Perron.

0 Comments